August 2022 : Index Outlook and Sectoral Earnings By ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Cooling off commodity prices provide comfort amid marginal decline in earnings post Q1; remain positive-

The recent cool off in key commodity prices viz. metals, crude among others comes as a breather for global equity markets, which are currently wary of ongoing geopolitical issues and interest rate hikes by central banks to control inflation. Management commentary is upbeat on demand prospects and recovery in margin profile amid muted corporate earnings for Q1FY23, which witnessed low single digit QoQ growth in topline and double digit bottomline decline with pressure on gross margins. Nifty EPS for Q1FY23 came in at ~| 177/share, down 14% QoQ. Major disappointment came in from the oil & gas sector wherein marketing margins came in lower than estimated. However, capital goods, metals & mining and pharma space surprised on the positive side. Domestically, with a capex cycle revival on the anvil (public + private) coupled with strong consumer demand across most categories (passenger vehicles, retail, etc), Indian markets witnessed a smart recovery and were up ~18% from recent lows. We remain constructive on the overall markets and believe the present market offers an attractive risk-reward play to build a long term portfolio of quality companies, which have lean balance sheets, are capital efficient in nature and have growth longevity.

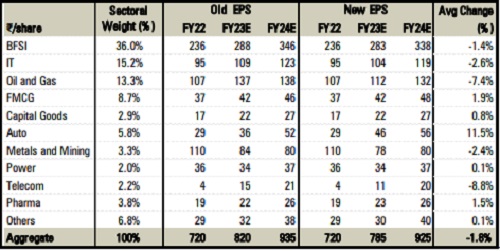

Incorporating revised PAT estimates post Q1FY23, our forward estimates witness a decline of ~2%. Over FY22-24E, albeit on a high base, Nifty earnings are seen growing at a CAGR of 13.3%. We now value the Nifty at 19,425 i.e. 21x PE on FY24E EPS of | 925 wherein we marginally increase our PE multiple to 21x vs. 20x earlier tracking cool off in commodity prices and consequent positive impact on inflation and resultant modest rate hike velocity by central banks vs. the aggressive stance depicted earlier.

Sectoral earnings

Incorporating Q1FY23 results, single digit downgrades were seen across most sectors with upgrades visible only in the auto, FMCG and pharma space

Highlights

* Global & domestic markets witnessing volatility over ongoing geopolitical issues and interest rate hike by key central banks. RBI increased the repo rate by another 50 bps to 5.4% in August 2022 with total rate hike pegged at 140 bps in the current upcycle

* On the economic parameters front, data points are encouraging in terms of GST collection, PV sales order-book and e-way bill generation (four-months high of 7.6 crore in July 2022)

* Monthly GST collection came in at a three month high of | 1.5 lakh crore for July 2022 vs. | 1.45 lakh crore in June 2022 & | 1.41 lakh crore in May 2021

* Incorporating the revised estimates, our Nifty earnings undergo a small downward revision of ~2%. We now value the Nifty at 19,425 i.e. 21x PE on FY24E EPS of | 925/share vs. 20x PE earlier taking some comfort from recent cool-off in commodity prices. Corresponding target for the Sensex is at 64,700. These are our rolling 12 months’ index target

* As structural bets, we like capex linked capital goods, domestic consumption plays including autos and PLI oriented domestic manufacturing play

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Markets continue to trade in high spirit