Stocks gain, dollar softens as peak inflation bets rise

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The dollar softened against major currencies and European stocks ticked higher on Thursday as easing U.S. inflation expectations reinforced investor confidence of a let up in price pressures.

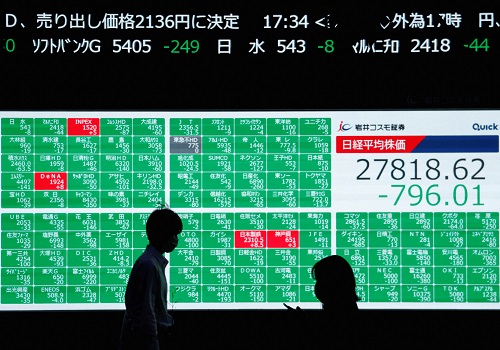

The Japanese yen inched closer to the four-month peak it scaled against the dollar on Tuesday after a hawkish policy tweak by the Bank of Japan fuelled widespread bets that the most dovish central bank of 2022 would roll back monetary stimulus.

Easing gas prices pulled U.S. consumer 12-month inflation expectations down to 6.7% this month, the lowest since September 2021, data showed on Wednesday.

Meanwhile consumer confidence rose to its highest reading since April, beating expectations of economists polled by Reuters and sparking a rally on Wall Street that lifted beaten-down European stocks on Thursday.

While the US Federal Reserve raised its main interest rate by 50 basis points in its seventh hike of the year in December, money managers are expecting the world's most influential central bank to soften its stance as inflation ebbs lower.

"The view is that we are getting close to the end of rate hikes and perhaps there will be a (Fed) pivot," said Anish Grewal, portfolio manager at London-based hedge fund Enora Global.

"Markets are too relaxed about this," he said, but "the expectations are that we get to around September next year and we are in rate-cutting mode."

Europe's Stoxx 600 share index rose 0.3%, putting it on course for a near 2% weekly gain, though it remains on track for a double-digit annual loss.

The chipper mood looked to spill over to Wall Street with S&P 500 futures and Nasdaq futures both up 0.2% on Thursday.

The dollar index , which measures the U.S. currency against a basket of six others, slipped 0.4 per cent in early European trading, taking it almost 2% lower so far this month.

The weaker dollar also cushioned sterling after data showed Britain's economy contracted more than first thought in the third quarter. Though the pound slipped 0.1% to $1.20.

Investors continue to grapple with the fallout of the Bank of Japan's (BOJ) shock decision to allow JGB yields to rise this week, leading many to assume an outright tightening of policy is only a matter of time.

Ten-year government bond yields had soared 23 basis points this week to 0.480%, the highest since July 2015 and within a whisker of the BOJ's new ceiling of 0.5%.

"The jump in yields and the further strengthening of the yen will lower the value of assets owned by Japanese investors," analysts at Capital Economics said.

"Insurance firms will be most affected by falling bond prices, whereas pension funds have most to lose from a stronger exchange rate. However, we doubt that lower investment returns carry systemic risks."

Capital Economics also now expects the dollar to drop toward 125 yen next year.

The pullback in the dollar has been a boon for gold, which was up 1.4% on the week so far at $1,818 an ounce. [GOL/]

Oil prices rallied after data showed a larger-than-expected draw in U.S. crude stockpile with a massive snowstorm expected to blanket much of the United States and hit travel-related demand for fuel. [O/R]

Brent and U.S. crude rose 42 cents to $82.56 and $78.67 respectively per barrel. [O/R]