Angel One Limited registers 133.6% YoY growth in its client base to 8.76 million in February 2022

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

The company’s growth across business parameters on the back of digital-first solutions has led to a 74.8% YoY increase in the number of orders to 70.30 million

Mumbai, 8th March 2022: Fintech company Angel One Limited (formerly known as Angel Broking Limited) has declared its monthly business numbers. Continuing its expansion streak, the company’s client base has grown to 8.76 million in February 2022, a 133.6% YoY increase. The growth in client base is led by the gross client acquisition of 0.45 million in the month, a 54.0% YoY increase.

The Fintech company registered 70.30 million orders in a month, a 74.8% YoY increase. Angel One’s Average Daily Turnover (ADTO) for February 2022 was Rs 8.88 trillion, a 121.7% YoY growth. The Average Client Funding Book witnessed a surge of 77.8% YoY to Rs 16.38 billion. Similarly, the company’s overall retail equity turnover market share stands at 20.8%.

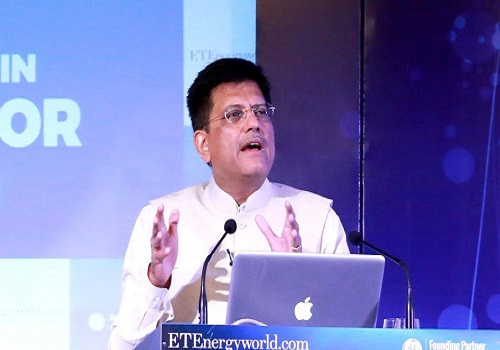

Talking about February 2022 growth numbers, Mr. Prabhakar Tiwari, Chief Growth Officer, Angel One Ltd, said, “We are providing our clients with state-of-the-art services through our technologically advanced digital platforms, leading to a consistent expansion in the client base. Our aim is to continue simplifying finance and wealth creation for people across the country. In line with this, we will continue to make efforts to penetrate the untapped potential in tier 2, 3 & beyond cities.”

Mr. Narayan Gangadhar, Chief Executive Officer, Angel One Ltd, said, “We are glad that every month more and more people are accessing our seamless digital services. Our goal is to make the client experience simpler and smoother. Our tech team is already working on the super app which is currently in the beta testing stage. The app will be rolled out in the next quarter. Our priority is superior user experience, and we will do everything possible to make it happen.”

The Fintech company has augmented its focus on digitally and technologically advanced solutions. Currently, it is working on introducing a super app, wherein the users will be able to access multiple financial services through one app.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One