The high Open Interest concentration on Call side is seen at 33,500 strike - Axis Securities

Bank Nifty

* The high Open Interest concentration on Call side is seen at 33,500 strike followed by 34,000 which may act as immediate resistance.

* The high Open Interest concentration on Put side is seen at 32,500 strike followed by 32,000 which may act as immediate support.

* Total Premium of A-T-M option is at Rs. 522 and probable trading range indicated for the day could be 32,300 to 33,700.

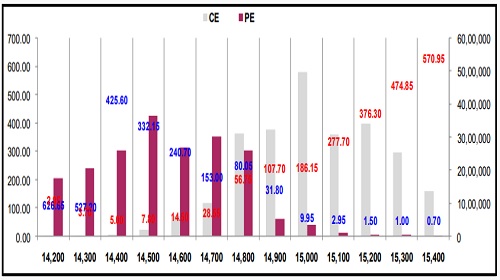

Nifty

* The high Open Interest concentration on Call side is seen at 15,000 strike followed by 15,200 which may act as immediate resistance.

* The high Open Interest concentration on Put side is seen at 14,500 strike followed by 14,700 which may act as immediate support.

* Total Premium of A-T-M option is at Rs. 137 and probable trading range indicated for the day could be 14,600 to 15,000.

To Read Complete Report & Disclaimer Click Here

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer