ICICI Prudential Mutual Fund launches India’s first Auto ETF - ICICI Prudential Nifty Auto ETF

Highlights:

* An open-ended ETF tracking Nifty Auto Index designed to reflect the behavior and performance of the Automobile segment of the financial market.

* The offering aims to provides exposure to blue chip auto and auto ancillary names which are part of the benchmark indices

* Demand momentum for autos to sustain on back of strong recovery in macro activities and opening up of the economy

* Minimum investment required during NFO: Rs. 1000/- and in multiple of Re. 1/-

Mumbai : ICICI Prudential Mutual Fund has launched India’s first Auto ETF namely ICICI Prudential Nifty Auto ETF. The offering aims to provide returns that closely correspond to the total return of the benchmark Nifty Auto Index subject to tracking errors.

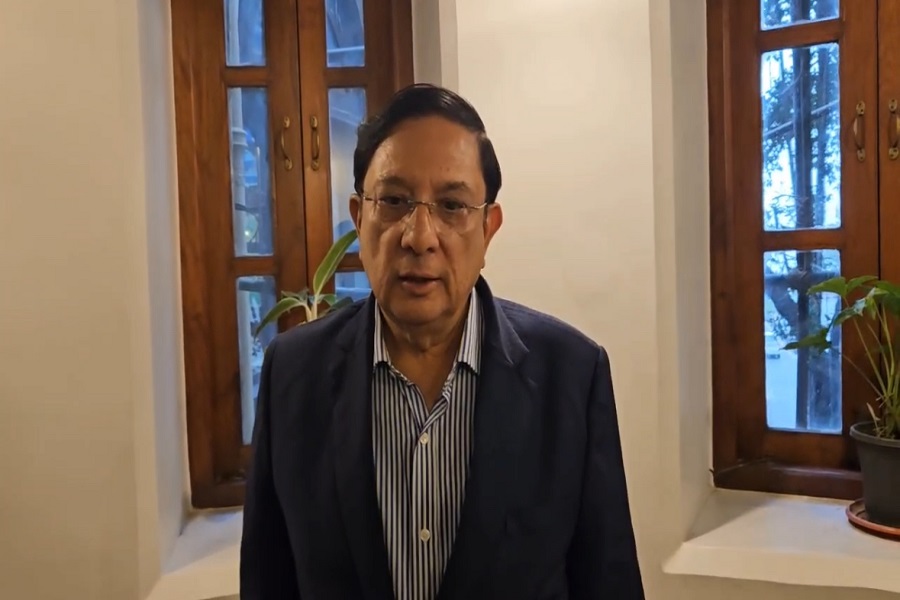

Speaking on the launch of the product, Mr. Chintan Haria, Head – Product Development & Strategy, ICICI Prudential Mutual Fund said, “We believe through ICICI Prudential Nifty Auto ETF, investors will be able to tap into the evolving space of the Indian automobile industry. With India being an emerging global hub for auto component sourcing coupled with the Government support for electric mobility, we believe this space is likely to be under the spotlight. “

From an industry perspective, auto is cyclical in nature i.e. it closely follows the various phases of the economic cycle. The profits of the companies that operate in this space rise or fall in line with consumer confidence. However, this is one industry which boasts of much higher return on capital employed (RoCE) and cash generation compared with other sectors, attributable to good margins and higher asset turnover. Some of the factors which augur well for the sector is the growing average household income leading to higher purchasing power, availability of skilled labour at relatively lower cost, presence of robust research and development centres aiding in sector growth and supportive Government policies for boosting electric mobility in the country

About the Index

The Nifty Auto Index is designed to reflect the behavior and performance of theAutomobiles segment of the financial market. The universe for the offering is Nifty 500. No single stock shall be more than 33% and weights of top 3 stocks cumulatively shall not be more than 62% at the time of rebalancing. The index is rebalnced semi annually in March and September respectively

Index Performance

The Nifty Auto TRI has outperformed Nifty 50 TRI in 7 of the 11 preceding years.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer