No Record Found

Latest News

PM SVANidhi scheme aims to benefit 1.15 crore benefi...

Locals see boost in jobs as PM Narendra Modi inaugur...

Draft Electricity Amendment Bill 2025 key to Viksit ...

Tamil Nadu: Tiruchy to tap local influencers to boos...

PM Narendra Modi inaugurates Guwahati terminal, sett...

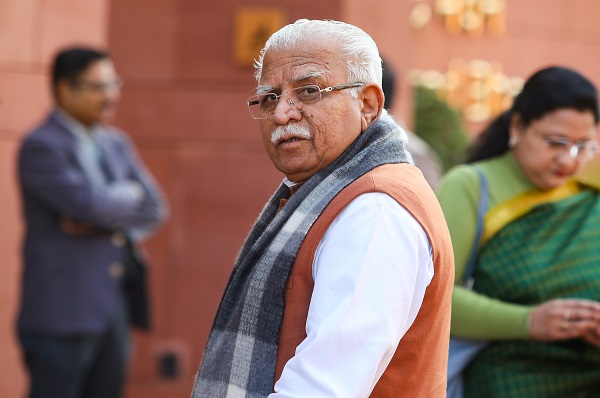

States must utilise Centre?s funds timely: Manohar K...

FM Nirmala Sitharaman discusses simplification of pr...

India-Oman CEPA to boost exports, energy security

India becomes world's 4th largest economy from 10th ...

`25 more days of wages`: Poor households welcome VB-...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found