Weekly Note For 26 August 2022 : The benchmark indices headed toward a weekly decline - Sunil Damania, MarketsMojo

Below is the Weekly Equity Outlook By Sunil Damania, Chief Investment Officer, MarketsMojo

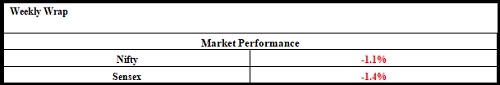

The benchmark indices headed toward a weekly decline, ending the 5-week-long positive streak. The market witnessed some profit booking amid concerns over the outcome of the US FED speech later Friday. Indian equities have seen positive momentum in the recent week with an increased infusion of foreign funds and easing domestic inflation numbers.

However, global markets focus remains on US Fed Chair Jerome Powell’s speech at the Jackson Hole Economic Symposium on 26th August-22 for fresh cues on their policy stance moving forward.

Markets also witnessed a sell-off on the August-22-month F&O expiry day towards the end of the trading session despite the net inflows by institutional investors during the week.

FIIs have infused close to Rs. 50,000 crores in the equity markets this month, the highest in the last 20 months. The recent correction in commodity prices and the retreating US Dollar from record highs has aided the re-entry of FIIs in the Indian markets.

The uptrend will be continued as the return of FIIs amid the festive season coming in. The demand is expected to remain elevated, which could work in favour of the Indian markets.

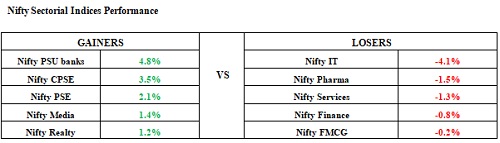

PSE stocks have been amongst the top picks in the last week, while sentiments towards the IT sector remain feeble. Investors moved away from IT stocks as major players delayed or trimmed the variable pay component, hinting toward pressure margins that clouded the sector's outlook.

Top listing this week

Syrma SGS Technology witnessed a positive debut in the Indian Equity market despite intense volatility as the stock prices soared 43% on listing day. A robust IPO subscription and a diversified product portfolio led to an optimistic opening.

Syrma SGS IPO aimed to raise capital expenditure funds to develop an R&D facility and expand manufacturing facilities.

Above views are of the author and not of the website kindly read disclaimer