Nifty futures closed at 14579 on a negative note with 13.31% - Axis Securities

HIGHLIGHTS:

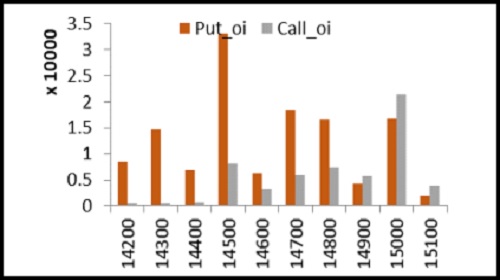

Nifty Options OI Distribution

Nifty futures closed at 14579 on a negative note with 13.31% increase in open interest indicating Short Build Up. Nifty Futures closed at a premium of 49 points compared to previous day premium of 72 points. BankNifty closed at 34870 on a negative note with 9.79% increase in open interest indicating Short Build Up. BankNifty Futures closed at a premium of 67 points compared to the previous day premium of 171 point

FII's were Sellers in Index Futures to the tune of 3806 crores and were BUYERS in Index Options to the tune of 3379 crores, Sellers in the Stock Futures to the tune of 700 crores. Net Sellers in derivative segment to the tune of 1398 crores.

India VIX index is at 28.14 v/s 22.89.Nifty ATM call option IV is currently 23.93 whereas Nifty ATM put option IV is quoting at 29.08

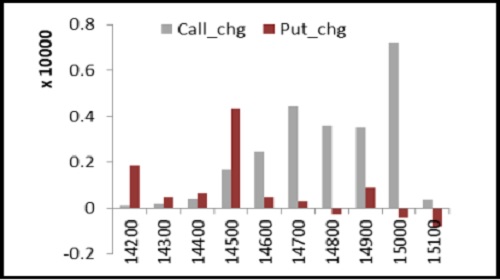

Nifty Options - Change in OI

Index options PCR is at 1.12 v/s 1.23 & F&O Total PCR is at 0.93. Among stock futures Long Build up are SAIL, COLPAL, may remain strong in coming session.

Stock which witnessed Short Build up are BERGERPAINT, HDFCLIFE, INDUSTOWER & BANKBARODA may remain weak in coming session.

Nifty Put options OI distribution shows that 14000 has highest OI concentration followed by 14500 & 14700 which may act as support for current expiry.

Nifty Call strike 15000 followed by 15500 witnessed significant OI concentration and may act as resistance for current expiry.

To Read Complete Report & Disclaimer Click Here

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

More News

Nifty opened on a flat note and remained in a small range throughout the day - Jainam Share ...