Model Portfolio Update - Nifty fair value pegged at 19,425 By ICICI Direct Ltd

Nifty fair value pegged at 19,425

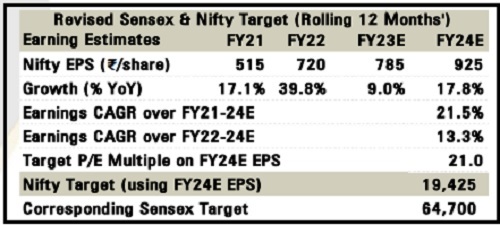

Over FY22-24E, albeit on a high base, Nifty earnings are seen growing at a CAGR of 13.3%. We now value the Nifty at 19,425 i.e. 21x PE on FY24E EPS of | 925 wherein we marginally increase our PE multiple to 21x vs. 20x earlier tracking a cool-off in commodity prices and consequent positive impact on inflation and resultant modest rate hike velocity by central banks vs. the aggressive stance depicted earlier.

• Corporate earnings for April-June 2022 (Q1FY23) came in muted, primarily due to pressure on gross margins during the quarter amid ongoing geopolitical conflicts and improving supply chain dynamics. Nifty EPS for Q1FY23 came in at ~| 177/share, down 14% QoQ. Major disappointment came in from the oil & gas sector wherein marketing margins came in lower than estimated. However, capital goods, metals & mining and pharma space surprised on the positive side

• The recent cool-off in key commodity prices viz. metals, crude among others comes as a breather for global equity markets, which are currently wary of ongoing geopolitical issues and interest rate hikes by central banks to control inflation. Management commentary across businesses was positive on demand outlook and with recent cool-off in key commodity prices was hopeful of margin recovery, going forward

• Domestically, with a capex cycle revival on the anvil (public + private) coupled with strong consumer demand across most categories (passenger vehicles, retail, etc), Indian markets witnessed a smart recovery and were up ~18% from recent lows

• We remain constructive on the overall markets and believe the present market offers an attractive risk-reward play to build a long term portfolio of quality companies, which have lean balance sheets, are capital efficient in nature, and have growth longevity

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer