Expiry Express - Bank Nifty opened flattish and moved in a consolidative fashion By Motilal Oswal

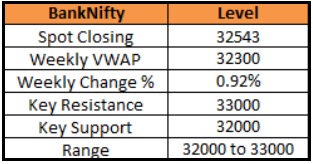

BANK NIFTY : 32543

Bank Nifty opened flattish and moved in a consolidative fashion with buying on declines throughout the day. Positive undertone continues in all the banking stocks and the index closed with gains of around 100 points. It formed a Bullish candle on daily scale and continues its formation of high highs - higher lows from the last two sessions. Now it has to continue to hold above 32200 zones to witness an up move towards 32750 and 33000 zones while on the downside support exists at 32000 and 31750 zones.

Expiry day point of view:

Overall trend is buy on decline strategy till it holds above 32200 zones

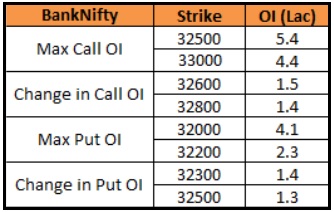

Bank Nifty a hold above 32200 zones could see an up move towards 32750 then 33000 zones. Option traders are suggested to trade with nearby Call like 32600 and 32700 strikes or Bull Call spread

Trading Range: Expected trading range : 32000/32200 to 33000 zones

Option Writing : Option writers are suggested to write OTM 33000 Call and 31900 Put with strict stop loss

Weekly Change : Bank Nifty is up by 0.92% at 32543 on a weekly basis. Bank Nifty VWAP of the week is near to 32300 levels and it is trading 250 points higher to the same indicates bullish bias.

Key Data

Option Weekly Activity

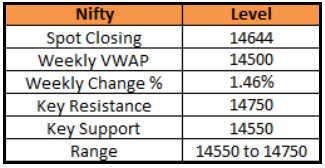

NIFTY : 14644

Nifty index opened positive, took support at previous day's closing levels and extended its gains to hit a fresh all-time high of 14666 levels. Index has been holding on to higher levels and making fresh record highs with its highest daily close above 14600 zones. It formed a Bullish candle on daily scale and continued its formation of higher tops - higher bottoms from the last two sessions. Now, it has to continue to hold above 14500 zones to extend its move towards 14750 then 15000 zones while on the downside immediate support exists at 14450 and 14350 levels

Expiry day point of view:

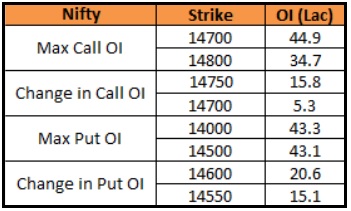

Overall trend is bullish with buy on any small declines strategy. Option traders are suggested to be with positive bias for an up move towards 14750-14800 zones. Buy nearby 14600 and 14650 Call or Bull Call Ladder Spread.

Trading Range :

Expected wider trading range : 14550 to 14750 zones

Option Writing : Aggressive Option writers can sell 14750 and 14500 Put with strict double stop loss

Weekly Change : Nifty index is up by 1.46% at 14644 on a weekly basis. Nifty VWAP of the week is near to 14500 levels and it is trading 150 points higher to the same indicates overall bullish bias.

Key Data

Option Weekly Activity

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

More News

Quote on Market Wrap 15th December 2025 by Mr. Ajit Mishra - SVP, Research, Religare Broking...