No Record Found

Latest News

Market Commentary (closing) for 17th February 2026 b...

Quote on Market Wrap 17th Feb 2026 from Mr. Ajit Mis...

Quote on Post market comment for Tuesday Feb 17 by A...

?Netflix, YouTube, Meta, X all must operate within c...

Preparations underway in Tripura ahead of Union Home...

Sensex, Nifty extend gains for 2nd day; PSU banks an...

RBI likely to hold rates steady in FY27 as inflation...

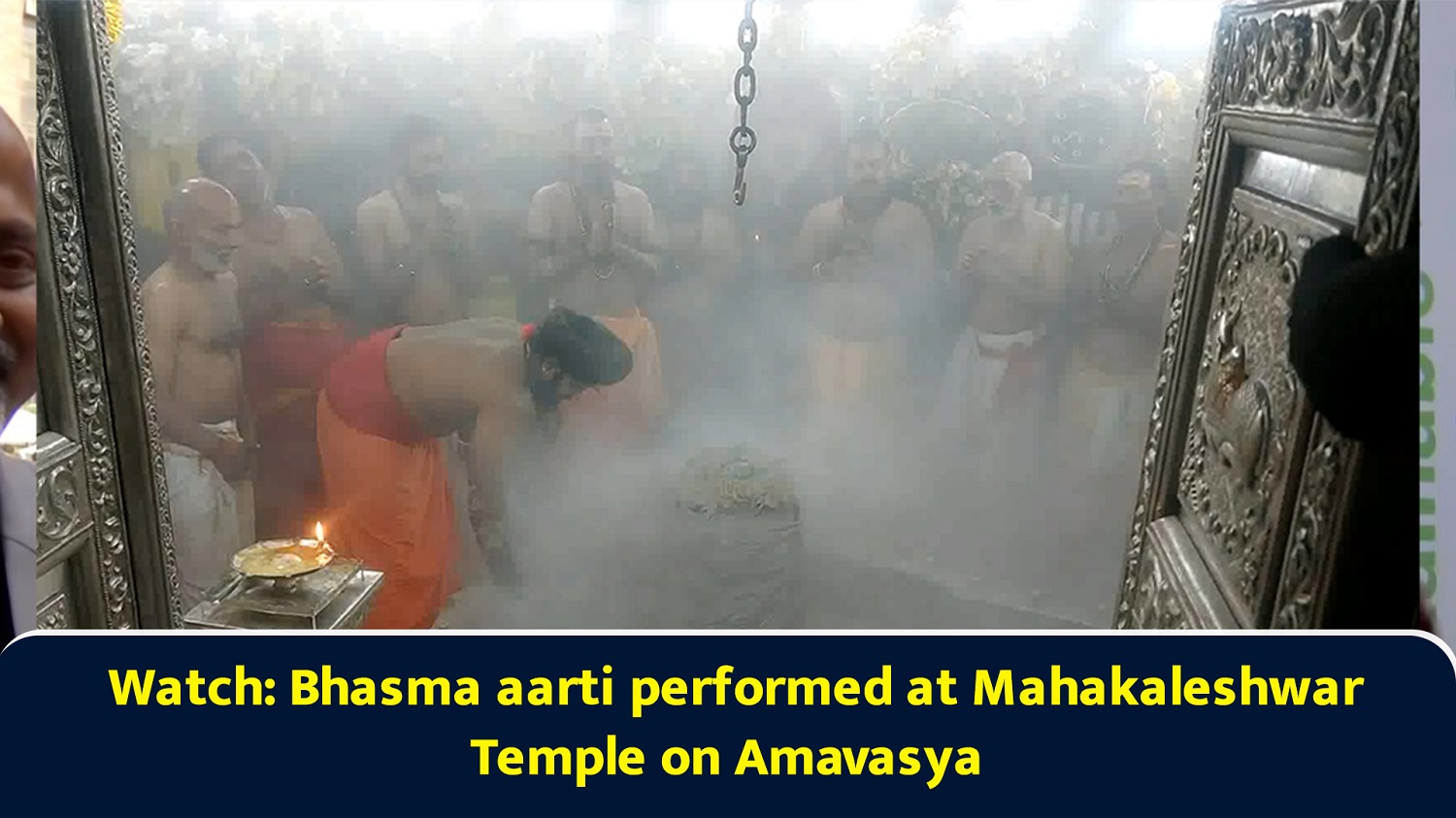

Watch: Bhasma aarti performed at Mahakaleshwar Templ...

India`s passenger vehicle growth likely at 4-6 pc in...

AI wave will reshape nearly every knowledge job: Aut...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found