No Record Found

Latest News

Several key bridges exemplify scale and vision of In...

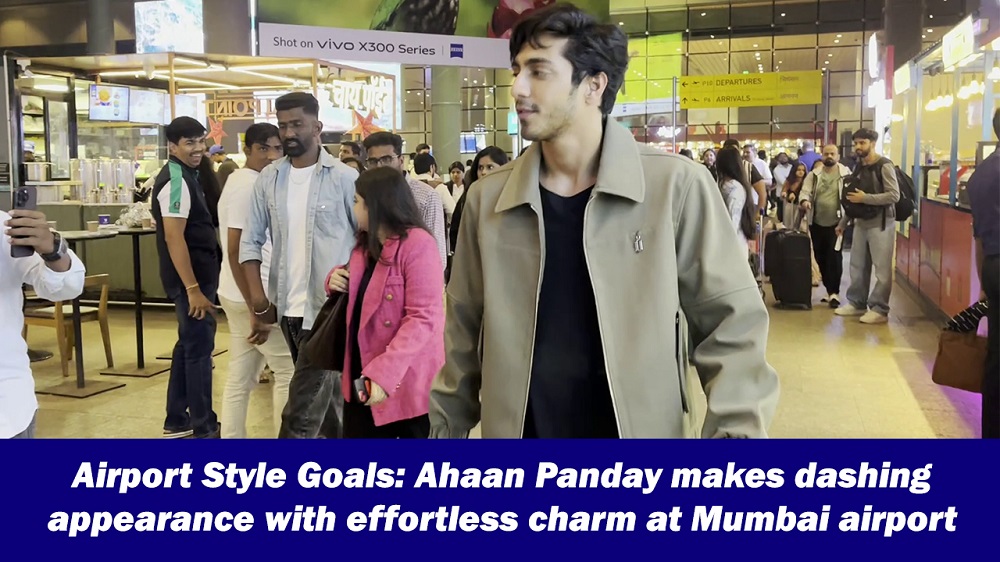

Airport Style Goals: Ahaan Panday makes dashing appe...

Add Coforge Ltd for Target Rs. 2,045 by Choice Insti...

Tamannaah Bhatia makes stylish airport appearance in...

Sambhal`s local crafts to adorn Christmas decoration...

Company Update : Solar Industries India Ltd by Prabh...

Ambassador of India to Estonia Ashish Sinha praises ...

PM Narendra Modi to Inaugurate new terminal building...

India-Oman CEPA to boost trade, investment and mobil...

Buy Shriram Finance Ltd For Target Rs.1,060 by Prabh...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found