No Record Found

Latest News

GST has reshaped India`s economic landscape, says PM...

GST enhanced taxpayer base, Ease of Doing Business i...

Evening Roundup : A Daily Report on Bullion Energy &...

MOSt Market Roundup : Nifty future closed positive w...

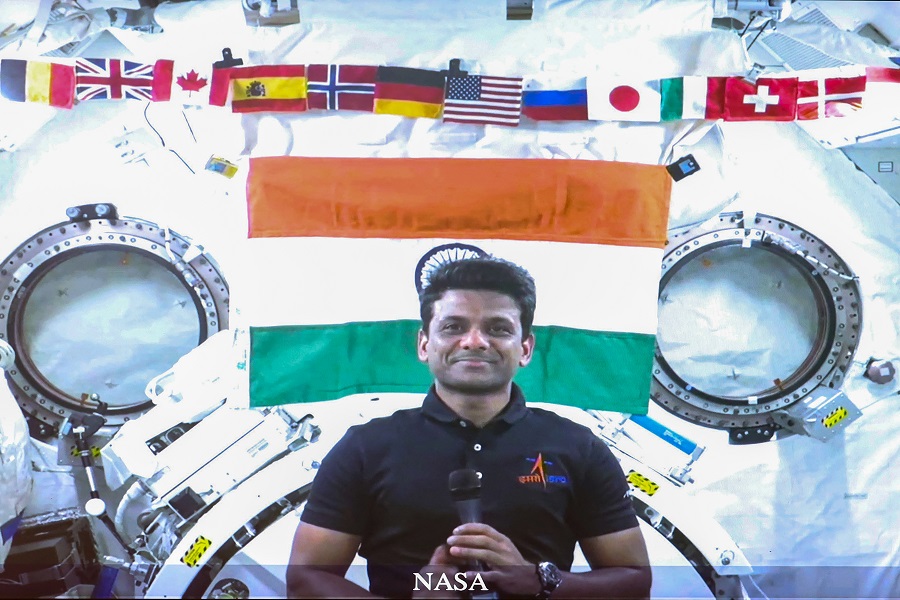

Shubhanshu Shukla leads experiment to decode muscle ...

Cabinet approves Rs 1,853 crore project to build 4-l...

Quote on Rupee 01 July 2025 by Jateen Trivedi, VP Re...

Quote on Gold 01 July 2025 by Jateen Trivedi, VP Res...

Nasscom unveils Talent Council to drive India`s futu...

Quote on Market 01 July 2025 by Vinod Nair, Head of ...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found