If having more women directors boosts returns, why is India Inc. shying away?

Now Get InvestmentGuruIndia.com news on WhatsApp. Click Here To Know More

Behind every great man, there’s a great woman. Behind every great company board, there are at least two, suggests a study by Bank of America Merrill Lynch (BofA ML).

“Asia Pacific stocks with at least two female board members have a price-earnings valuation premium, higher net profit margins and dividend yield," BofA ML said in a report on 6 March. The broker said gender diversity can boost return on equity and market capitalization, and that too, at less risk.

However, despite these facts, the Asia- Pacific region has a long way to go when it comes to having more women members on company boards. Women comprise 49% of Asia’s population and 36% of the gross domestic product (GDP), but just 12% of board seats, according to BofAML.

The study also shows that companies with at least two women on the board are about 2.5 times the size of firms that have fewer representation of women, on an average. As such, in Asia-Pacific, the problem appears to be greater in smaller firms.

However, in India, it seems to be a universal problem. Multiple committees on corporate governance have goaded Indian companies to increase representation of women, but the response has been half-hearted.

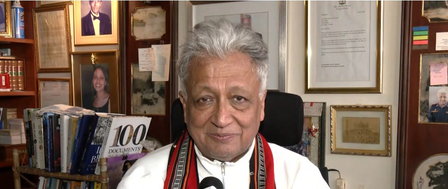

“The 2014 Companies Act mandated that there should be one woman director on each board, but companies met this requirement by employing their female relatives/friends. As such, Sebi (Securities and Exchange Board of India) suggested that there should be at least one independent woman director on the company board. However, that law is yet to be implemented. The issue here is that a legislation of this kind may not meet the purpose—it does not have be forceful. It needs a cultural and mindset change, and it will take time to yield results," said J.N. Gupta, managing director of Stakeholders Empowerment Services.

Good corporate governance cannot be legislated and if companies themselves can’t see the benefits of higher return ratios and valuations, legislation can go only so far in nudging them in the right direction.

There are other challenges as well. Women workforce participation trends at the entry level are encouraging. However, a large number of women drop out at the mid-stage of their careers for a variety of reasons.

As such, there is a supply issue that needs to be addressed as well. That’s what great company boards should do—invest in their women and ensure there is a steady stream rising up to leadership roles and board seats.