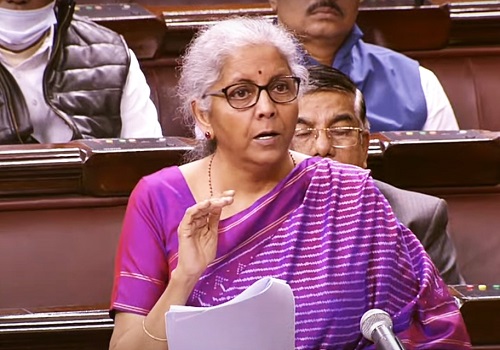

Over Rs 53,600 crore GST compensation yet to be released to states in FY22: FM Nirmala Sitharaman

Finance Minister Nirmala Sitharaman has said that Rs 53,661 crore of Goods and Services Tax (GST) compensation for the current fiscal (FY22) is yet to be released to the states. This include Rs 11,563 crore to be released to Maharashtra, Rs 6,954 crore to Uttar Pradesh, Rs 6,733 crore to Tamil Nadu, Rs 5,461 crore to Delhi and Rs 4,292 crore to West Bengal.

So far this fiscal, Rs 96,576 crore has been released to the states on account of GST compensation, and an additional Rs 1.59 lakh crore has been given as back-to-back loan to make good the revenue shortfall on account of Goods and Services Tax implementation. Under the Goods and Services Tax law, states were guaranteed to be compensated bi-monthly for any loss of revenue in the first five years of GST implementation from July 1, 2017.

The shortfall is calculated assuming a 14 per cent annual growth in GST collections by states over the base year of 2015-16. The compensation amount to be paid from the compensation fund is arrived at by levying cess on top of the highest tax slab on luxury, demerit and sin goods.

Further, she said GST compensation for financial years 2017-18, 2018-19, 2019-20 and 2020-21 has already been paid to the States/UTs. She stated the economic impact of the pandemic has led to higher compensation requirement due to lower GST collection and at the same time lower collection of GST compensation cess.