Volatility in the rupee has dropped in the last few months and this month - Motilal Oswal Financial Services

Currency

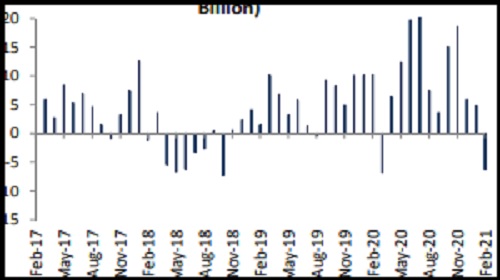

Volatility in the rupee has dropped in the last few months and this month was no different until the tables turned around on the last trading day. The rupee on Friday had one of the biggest single day falls in the last 11 months primarily sparked by surging US yields. One day of sharp depreciation hasn’t changed the overall fundamentals, but has shaken the overall sentiment of market participants. US benchmark yields rose to the highest level in more than a year thereby sounding a warning about the outlook for interest rates and inflation. GDP data released, on the domestic front, showed the economy grew a modest 0.4% in the October-December quarter. For the ongoing financial year, GDP is seen contacting 8%, deeper than 7.7% decline forecast earlier.

There is a lot of speculation that carry traders unwound a lot of short positions in the forwards as it was looking really attractive in the last few months. INR seems to be caught in a short squeeze and volatility may fail to curtail unless RBI comes to rescue from the other side. We suggest that one must be very cautious at least for the next couple of weeks after ATM option vols after quoting at around 4.5% have spiked to levels of over 10%.We could experience a global economic rebound with a global surge in inflation never experienced before and it is nobody’s call as in how it will start to play out. For the week, the USDINR(Spot) to trade with a positive bias and quote in the range of 73.40 and 74.50.

Global Currencies

Dollar in the last week of the month moved higher slowly and steadily, but for the whole of the month was weighed down on expectation of a stimulus package from the US. The greenback started to rebound also as economic numbers released from the US came in marginally betterthan-estimates. Trigger also came in after the Fed Chairman in his testimony before the U.S. Senate Banking Committee, acknowledged the potentially fast growth to come as the coronavirus crisis eases and vaccinations expand. Gains were capped after the Fed Chairman mentioned that interest rates will remain low and the Fed’s $120 billion in monthly bond purchases will continue at least at the current pace until we make substantial further progress towards our goals. This month, market participants will be keeping an eye on the FOMC policy statement and dovish outlook by the Fed Chairman could keep gains capped for the greenback.

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer