After two days of consolidation, the rupee managed to gain 10 paise to end at 72.65 levels. - ICICI Direct

INR Futures

* After two days of consolidation, the rupee managed to gain 10 paise to end at 72.65 levels. We feel the rupee is likely to appreciate further

* The dollar index on Friday posted moderate losses. A rally in GBP/US$ on Friday to a new two and a three-fourth year high weighed on the dollar along with strength in other G-10 currencies against the dollar

Global Bonds

* The Nifty tumbled around 1% on Friday on the back of broad based selling across sectors. According to option chain, on the Put side 15000 Put has the highest OI. If it sustains below 15000 then, we may see continuance of the current fall

* The Bank Nifty continued to remain under pressure as there was selling in most private sector banks along with midcap and PSU banks

FII & FPI Activities

Foreign institutional investors (FII) again turned buyers as they bought to the tune of | 2415 crore on February 16, 2021. They bought worth | 3285 crore in the equity market and sold worth | 870 crore in the debt market

US$INR futures on NSE

* The US$INR future gained some momentum and ended near 72.63 levels. Looking at the writing in OTM strike Calls we feel upsides are limited and a close below 72.4 levels would open the gates for lower targets

* The dollar-rupee February contract on the NSE was at | 72.63 in the last session. The open interest declined almost 3% in the February series

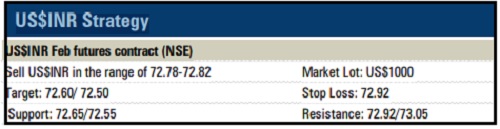

US$INR Strategy

US$INR Strategy

US$INR Feb futures contract (NSE)

Sell US$INR in the range of 72.78-72.82 Market Lot: US$1000

Target: 72.60/ 72.50 Stop Loss: 72.92 Support: 72.65/72.55

Resistance: 72.92/73.05

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer