No Record Found

Latest News

The Timeless Trend Making a Bold Comeback

Study links bacterium lurking in gums with heart rhy...

J&K L-G visits Pakistan shelling-hit area in Kupwara

Our government committed to fulfilling promises: CM ...

Thank you very much for this very warm gesture, says...

SAFF U19 C'ship: India aim to entertain crowd in sum...

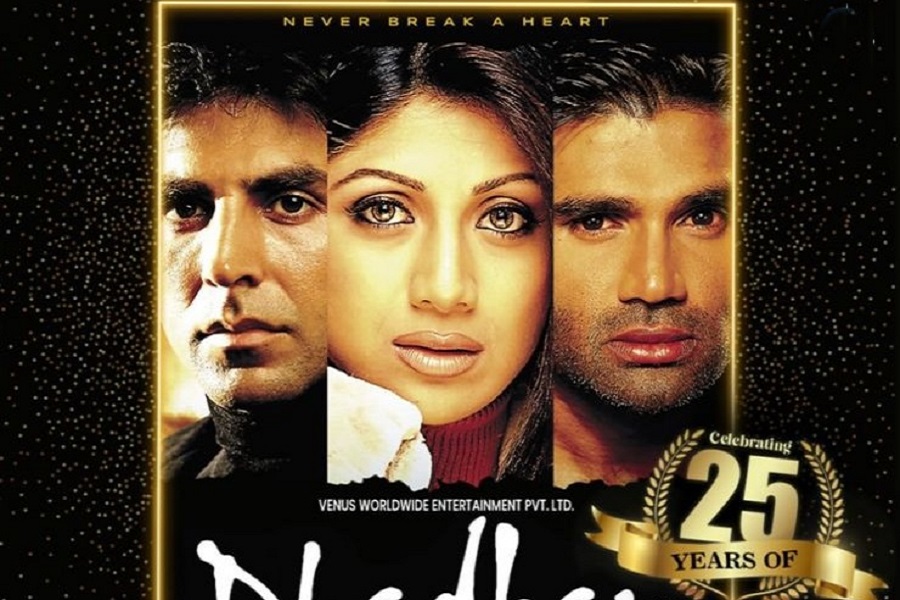

Akshay, Shilpa, Suniel celebrate re-release of ?time...

Trailer of Chhaya Kadam-starrer ?Snow Flower? draws ...

No update on #NTRNeel film for Jr NTR's birthday!

Centre to launch digital platform for e-filing in tr...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found