Sell Copper Mar 2021 @ 720.00 SL 728.00 TGT 708.00-698.00.MCX - Kedia Advisory

COPPER

* Copper trading range for the day is 690.2-726.4.

* Copper prices ended with losses as the global refined copper market showed a 77,000 tonne deficit in November

* Stocks of copper in Shanghai bonded areas increased on larger arrivals.

* A sharp decline in new orders amid surging copper prices prompted copper processors to slow down production

* Warehouse stock for Copper at LME was at 76225mt that is down by -2350mt.

SELL COPPER MAR 2021 @ 720.00 SL 728.00 TGT 708.00-698.00.MCX

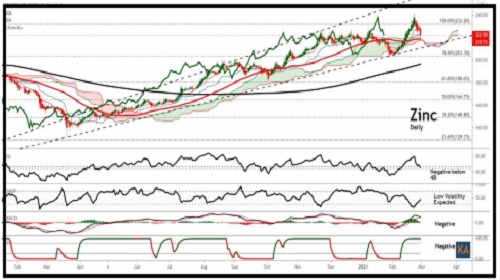

ZINC

* Zinc trading range for the day is 213.3-229.3.

* Zinc prices dropped after data showed that social inventories of refined zinc ingots across in China increased 37,600 mt.

* The yield of US 10-year treasury bonds hit a one-year high of 1.61%

* Several Fed officials unanimously declared that there is no need to worry about the rise in US bond yields

* Warehouse stock for Zinc at LME was at 269775mt that is down by -700mt.

SELL ZINC MAR 2021 @ 226.00 SL 228.50 TGT 223.50-221.00.MCX

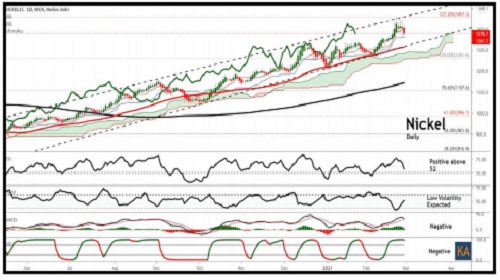

NICKEL

* Nickel trading range for the day is 1337.8-1413.2.

* Nickel prices dropped after the global nickel market sees larger surplus in December

* The global nickel market surplus rose to 14,600 tonnes in December from an upwardly revised surplus of 7,400 tonnes in the previous month

* Nickel ore inventories across all Chinese ports decreased 614,000 wmt from February 18 to 7.26 million wmt as of February 26, showed data.

* Warehouse stock for Nickel at LME was at 251130mt that is up by 72mt.

SELL NICKEL MAR 2021 @ 1390.00 SL 1405.00 TGT 1368.00-1354.00.MCX

ALUMINIUM

* Aluminium trading range for the day is 171-177.6.

* Aluminium prices dropped as pressure seen after primary aluminium ingot inventories in China rose.

* Social inventories of primary aluminium ingots across eight consumption areas in China, including SHFE warrants, increased 181,000 mt

* Aluminum prices are set to remain high driven by a recovery in demand from the Covid-19 hit.

* Warehouse stock for Aluminium at LME was at 1325875mt that is down by -6650mt.

SELL ALUMINIUM MAR 2021 @ 174.00 SL 176.50 TGT 171.50-169.50.MCX

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer