MCX gold prices declined almost 0.40% on Wednesday amid lower than expected US inflation data - ICICI Direct

Bullion Outlook

* MCX gold prices declined almost 0.40% on Wednesday amid lower than expected US inflation data. US consumer prices did not rise in July, due to a sharp drop in the cost of gasoline

* Further, rise in risk appetite in the global markets continued to pressurise safe haven assets

* However, a retreat in US 10-year bond yields along with weakness in dollar index prevented further downsides in precious metals prices

* MCX gold prices are expected to trade with a negative bias for the day amid optimistic sentiments in global markets. It is likely to get dragged down towards | 52,300 for the day. Further, silver prices are expected to take cues from gold prices and may move towards | 58,000 levels in coming sessions

* Additionally, investors will remain cautious ahead of initial jobless claims data from the US

Base Metal Outlook

* MCX Copper and other industrial metal prices advanced on Wednesday after relatively tame US inflation readings prompted bets that the Federal Reserve may not opt for aggressive rate hikes

* The premium of cash LME zinc over the three month contract rose to $127 a tonne, the highest since late June, indicating tightness in near term LME supplies as investors worry that high energy prices will force smelters to curb output

* However, China's factory-gate inflation eased to a 17-month low in July, data showed on Wednesday, as a slower domestic construction sector weighed on raw material demand

* MCX copper prices are expected to move towards | 680 for the day due to falling LME stockpiles and weak dollar index. Additionally, investors will focus on series of macro economic data from the US

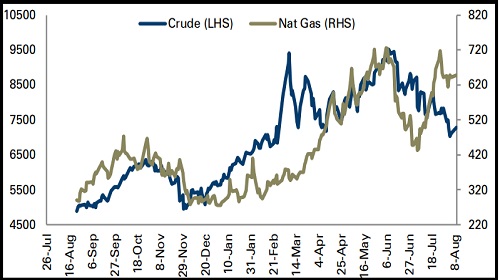

Energy Outlook

* WTI crude oil prices rallied more than 1.50% on Wednesday, supported by encouraging figures on US gasoline demand

* Further, US oil refiners and pipeline operators expect strong energy consumption for the second half of 2022, a Reuters review of company earnings calls showed

* However, a sharp increase in US oil inventories capped further gains in the prices. US commercial crude oil stockpiles surged to 432 million barrels from 426.55 million barrels over the past one week

* US natural gas futures rose around 3.60% on Wednesday as Russia continued to squeeze energy supplies to Europe

* MCX natural gas prices are expected to rally towards | 670 for the day amid concerns over lower gas flows to European countries from Russia. Additionally, investors will keep an eye on natural gas storage data from the US

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer