No Record Found

Latest News

Reaction on Market at Life Highs: Upside Capped ? Di...

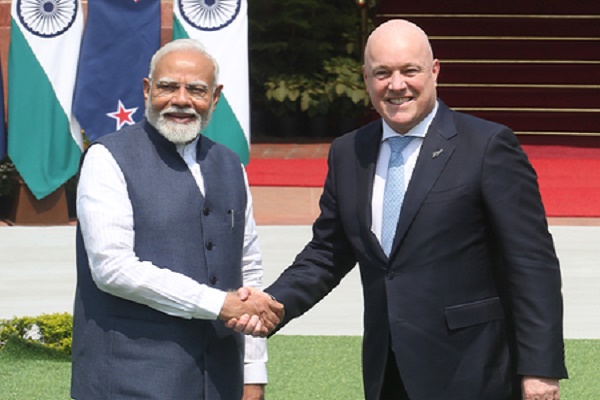

India-New Zealand FTA: PM Narendra Modi, Luxon aim t...

Abakkus Mutual Fund launches its ?Believe in the Bas...

Tiny Rs.10 Carts and Massive Rs.4.3 Lakh Single Orde...

MIC Electronics surges on securing LoA variation fro...

India, New Zealand seal historic FTA; tariffs on 95 ...

perspective on Year-end by Dr. Rudra Pratap, Foundin...

Project Khushi: Because behind every khaki is a huma...

RBI`s neutral stance provides flexibility against ev...

Tata Power-DDL Initiates ?Village Solar Brand Ambass...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found