No Record Found

Latest News

Blooming Lives: The Everyday Story of a Flower Seller

`New chapter being added in form of Van Mahotsav?` D...

BMW Group India posts highest-ever H1 car sales in 2...

Shivraj Singh Chouhan arrives at Srinagar Airport

Chennai emerging new salary hotspot for freshers

`You can stop when I stop?` Hollywood Actor Richard ...

118 million women consumers in India enter credit ma...

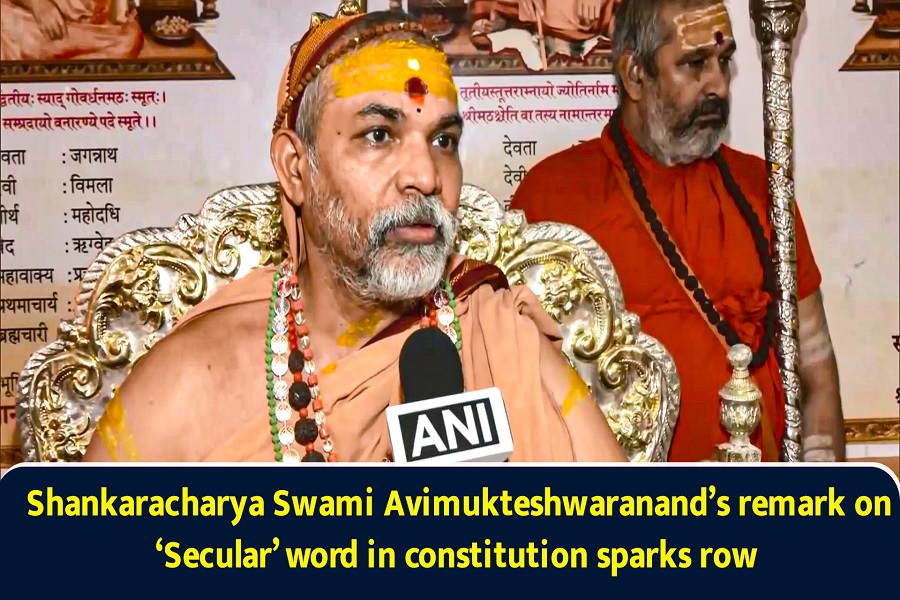

Shankaracharya Swami Avimukteshwaranand`s remark on ...

Evening Roundup : A Daily Report on Bullion Energy &...

Musk-run Starlink`s India authorisation still under ...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found