No Record Found

Latest News

Company Update : Apollo Hospitals Ltd By Motilal Osw...

India`s equity benchmarks likely to rise after Trump...

GST has reshaped India`s economic landscape, says PM...

GST enhanced taxpayer base, Ease of Doing Business i...

Evening Roundup : A Daily Report on Bullion Energy &...

MOSt Market Roundup : Nifty future closed positive w...

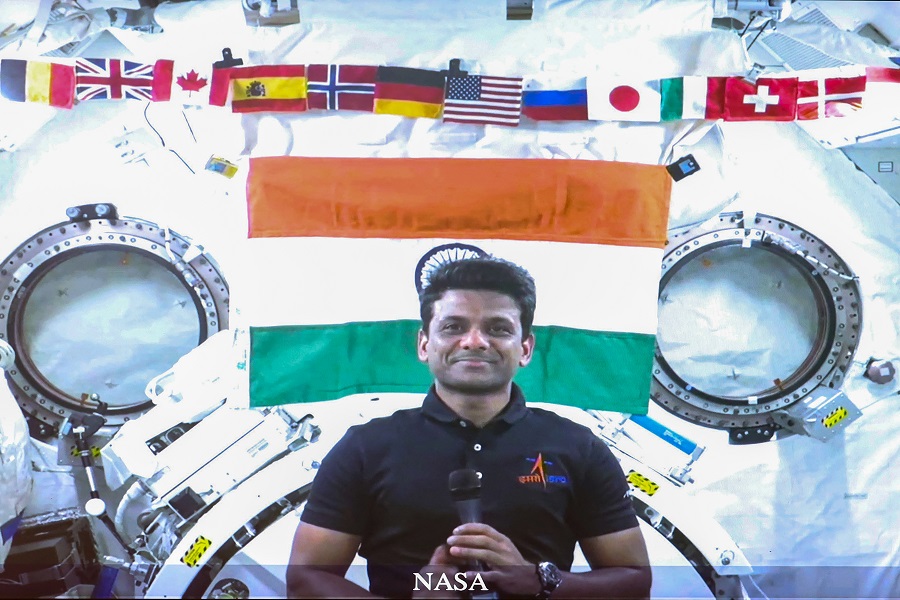

Shubhanshu Shukla leads experiment to decode muscle ...

Cabinet approves Rs 1,853 crore project to build 4-l...

Quote on Rupee 01 July 2025 by Jateen Trivedi, VP Re...

Quote on Gold 01 July 2025 by Jateen Trivedi, VP Res...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found