Stock Picks - Buy Indian Oil Corporation Ltd For Target Of Rs. 109 - ICICI Direct

Technical Observations

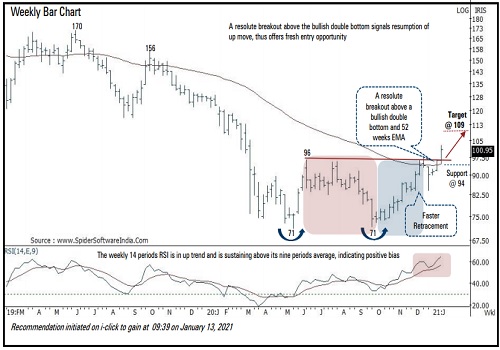

* The stock has generated a resolute breakout above the bullish double bottom as can be seen in the adjacent chart and in the process has also closed above the 52 weeks EMA (currently at | 94 levels) signalling strength and resumption of up move thus offers fresh entry opportunity

* It has also witnessed a faster retracement of the last falling segment as 16 weeks decline (| 96 to 71) was completely retraced in just 11 weeks. A faster retracement signals a robust price structure

* The stock has immediate support at | 96-94 levels being the confluence of the recent breakout area and 52 weeks EMA. Buying demand is expected to emerge in case of any corrective decline towards the support area (| 96-94)

* The weekly 14 periods RSI is in up trend and is seen rebounding from its nine periods average thus validates positive bias

* We expect the stock to resolve higher and head towards | 109 levels as it is the 161.8% external retracement of the entire previous decline ( | 96 to 71) placed around | 109 levels

Buy Indian Oil Corporation Ltd @ 97.00-100.00 TGT 109.00 SL 94.00

To Read Complete Report & Disclaimer Click Here

For More ICICI Direct Disclaimer http://icicidirect.com/disclaimer.html

SEBI Registration number is INZ000183631

Above views are of the author and not of the website kindly read disclaimer