No Record Found

Latest News

Daily Derivatives Report 19th January 2026 by Axis S...

Daily Technical Report 19th January 2026 by Axis Sec...

Interglobe Aviation soars on partnering with Nobero

Top 3 firms add Rs 75,855 crore in market valuation ...

Number of firms in South Korea`s free economic zones...

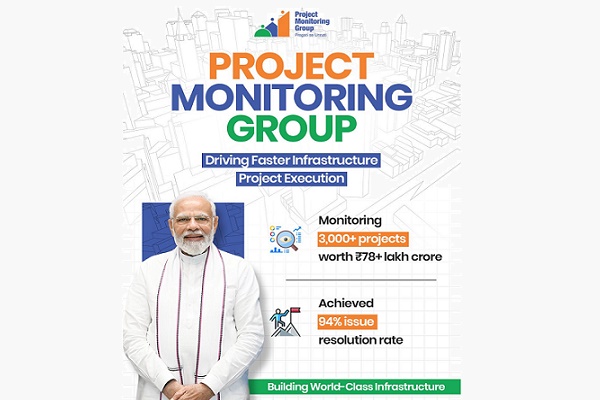

Government`s PMG accelerating over 3,000 projects wo...

Daily Updates Report 19th January 2026 from Ventura ...

India poised to make strong splash at WEF`s annual m...

CM Bhupendra Patel approves amendments to Gujarat Te...

Index opened the week with a negative gap-down, howe...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found