No Record Found

Latest News

NIFTY EPS CAGR at 14.8% over FY26?28, Budget to focu...

Accumulate JK Cement Ltd For Target Rs.6,249 By Elar...

Indian Banking and NBFC sector outlook positive on s...

81 pc Indian employers aware of PM-VBRY offering cas...

Budget 2026: Reforms to continue with restraint, say...

Flexi cap funds` AUM surge 148 pc in India in 4 years

Strategy: Index returns so-so, portfolio returns not...

India to host envoys of 83 countries at roundtable o...

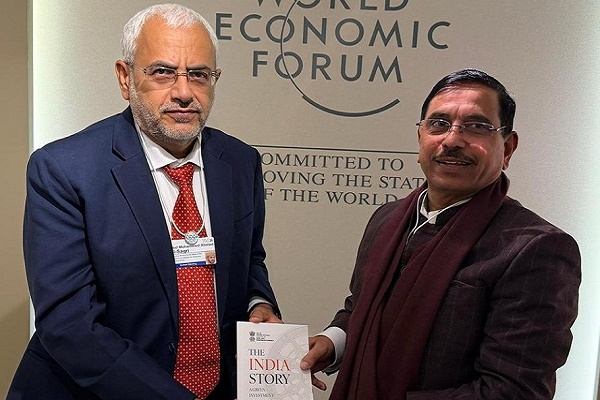

Pralhad Joshi makes strong pitch for investments in ...

95 pc Indian workers confident in skills, only 64 pe...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found