No Record Found

Latest News

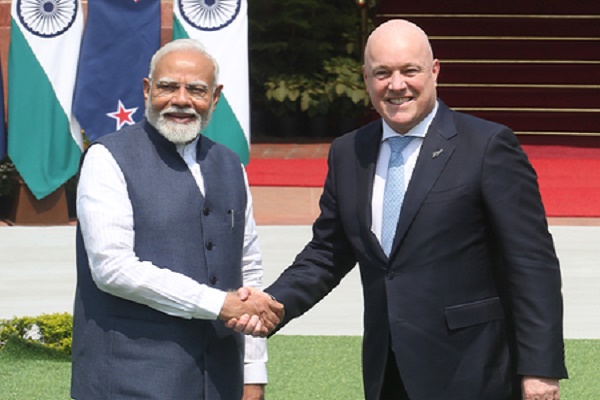

India, New Zealand seal historic FTA; tariffs on 95 ...

perspective on Year-end by Dr. Rudra Pratap, Foundin...

Project Khushi: Because behind every khaki is a huma...

RBI`s neutral stance provides flexibility against ev...

Tata Power-DDL Initiates ?Village Solar Brand Ambass...

Institutional investments in Indian real estate to s...

Luma AI announces Ray3 Modify, a new model for hybri...

Tata Steel gains on acquiring stake in TSHP

India Ranks Third Globally in Research Output, But Q...

REC jumps as its arm incorporates wholly owned subsi...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found