Auto Sector Update : March 2021: M&HCV growth led by good demand, easing finance - Motilal Oswal

Mar’21: M&HCV growth led by good demand, easing finance

PV/Tractor demand sustains; 2W gets year-end push

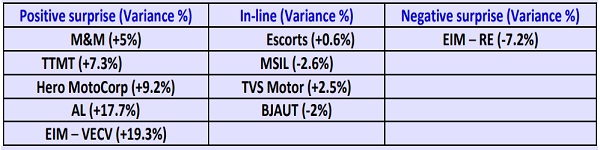

Tractor, PV, 3W, and 2W wholesales were in line with our estimates, whereas CVs were above our expectation. Strong demand and long waiting periods are seen for PV OEMs. Among 2Ws, TVS and BJAUT were in line, HMCL was above our estimates, and RE was below our estimates. PV/2W volumes were flat (v/s Mar’19). CV/MHCV volumes declined at a 12.8%/15.3% CAGR (v/s Mar’19). LCV volumes declined 10%, and 3W volumes declined at an 18.6% CAGR (v/s Mar’19).

* Snapshot of FY21 volume performance: 2W volumes declined 8.5% YoY in FY21 and PV volumes fell just 4.5% YoY. MHCV volumes fell 27.5%, and LCV declined 13.5% YoY. 3W volumes were the worst hit due to significant decline in local movement (WFH) and increased avoidance for shared mobility. Tractor volumes grew 20% in FY21.

* 2Ws – in-line, flat v/s Mar’19: Volumes recovered to Mar’19 levels and grew 7.4% MoM. While demand remains slow, inventory is at 30–45 days. Volumes were flat for BJAUT, HMCL, and TVS v/s Mar’19, but grew -0.7%, 14.1%, and 8% MoM, respectively. RE volumes posted a 4% CAGR over Mar’19 (declined 5.2% MoM).

* PVs – in-line, flat v/s Mar’19: Sustained demand resulted in volumes remaining flat (v/s Mar’19), but supply chain issues persist. MSIL’s volumes were in-line (2.8% CAGR v/s Mar’19) and grew 1.5% MoM. MM volumes (UVs including Pickups) posted a ~19.4% CAGR decline (v/s Mar’19, +36% MoM). TTMT’s PV volumes continued their strong performance with 28.2% growth (v/s Mar’19, +8.7% MoM).

* CVs – above expectation, 12.8% CAGR decline (v/s Mar’19): M&HCV volumes were above estimates, whereas LCV was in-line. M&HCV/LCV volumes declined ~15.3%/10% (v/s Mar’19), but grew +31%/+14.2% MoM. Volumes for AL posted a 10.5% CAGR decline (v/s Mar’19, +25.7% MoM). TTMT’s CV volumes reported a 14.9% CAGR decline (v/s Mar’19, +19.6% MoM). VECV also posted a 9.9% CAGR decline (v/s Mar’19, +28.9% MoM).

* Tractors – in line with estimate, up 17.1% CAGR (v/s Mar’19): Tractor volumes grew at a 17.1% CAGR (v/s Mar’19, +10% MoM) as issues on the supply side are slowly being resolved. Increased reservoir levels and high liquidity, coupled with a good rabi harvest, could support wholesales in the coming months. MM/ESC’s Tractor volumes posted a 25.4%/1.8% CAGR (v/s Mar’19).

Valuation and view: Mar’21 saw sustained demand across segments (ex-2W). Current valuations largely factor in sustained recovery (our base case), leaving a limited safety margin for any negative surprises. We prefer companies with: a) higher visibility in terms of demand recovery, b) a strong competitive positioning, c) margin drivers, and d) balance sheet strength. MSIL and MM are our top OEM picks. Among the auto component stocks, we prefer ENDU. We prefer TTMT as a play on global PVs.

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Above views are of the author and not of the website kindly read disclaimer