No Record Found

Latest News

SAMPANN-DigiLocker integration offers paperless docu...

Gold prices jump over 4 pc to hit record high

SELL TURMERIC APR @ 17900 SL 18100 TGT 17700-17500. ...

IBM CEO calls for AI sovereignty in India with focus...

`Draft NEP 2026` released for public consultation to...

A tsunami is hitting labour market with AI, we must ...

Export benefits for MSMEs rolled out on Postal chann...

AU Small Finance Bank Announces Q3`FY26/9M`FY26 Fina...

SELL NATURALGAS JAN @ 360 SL 366 TGT 352-344. MCX - ...

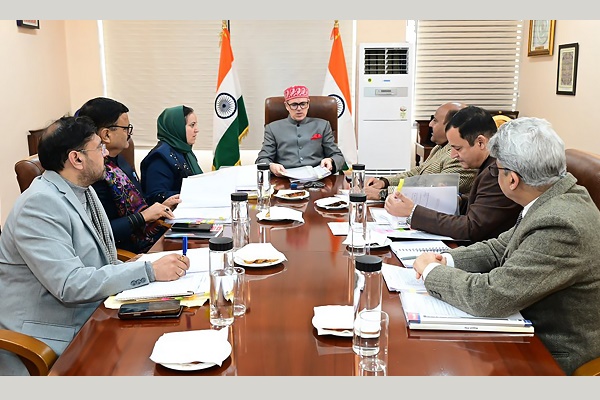

Omar Abdullah holds pre-budget consultation with key...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found