No Record Found

Latest News

LG Energy Solution's $2.69 billion battery deal with...

ESDS Software Solution gets SEBI`s approval for Rs 6...

FIIs stood as net sellers in equities as per Decembe...

Strides Pharma trades lower as its arm gets four obs...

Bondada Engineering gains on boosting order book wit...

Gujarat Industries Power jumps on commissioning fina...

RBI's Sovereign Gold Bond due for premature redempti...

India's logistics cost to drop significantly, Railwa...

Sensex, Nifty end lower as IT, auto stocks drag markets

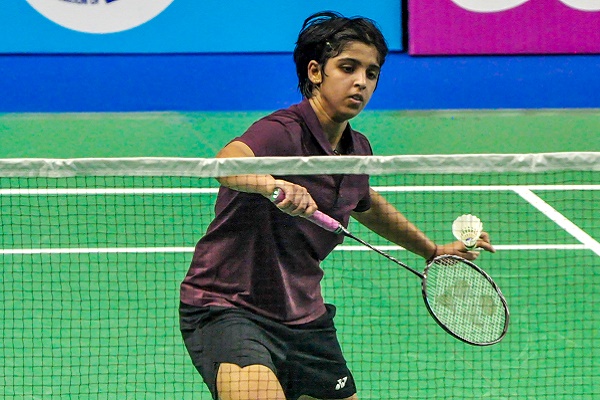

Senior National Badminton: Tanvi Sharma, Rounak Chau...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found