No Record Found

Latest News

Machine learning boosts credit access in India

PLI scheme for food processing industry sees investm...

India`s exports rebound stronger in November

S&P upgrades India`s insolvency regime on stronger c...

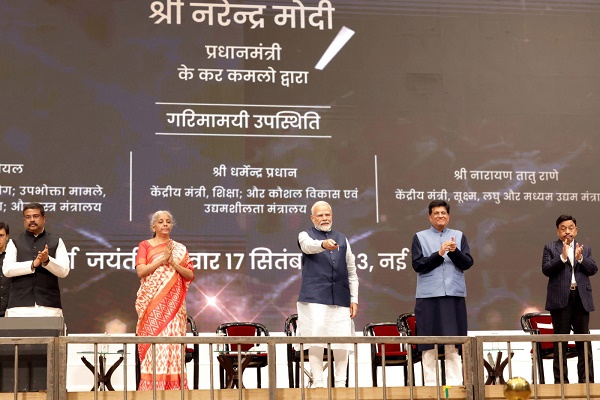

PM Vishwakarma Scheme: 23.09 lakh beneficiaries trai...

India`s smartphone exports to US jump over 300 pc in...

Mumbai`s Worli accounts for 40 pc of ultra-luxury re...

New labour codes enhance social security, ease emplo...

Evening Roundup : A Daily Report on Bullion Energy &...

Government to ensure that honest taxpayers can do b...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found