No Record Found

Latest News

Piyush Goyal upbeat over trade talks with EU

Technical Conviction Delivery Idea : State Bank of I...

Budget 2026-27: COAI urges government to reduce tele...

German Chancellor Merz visits Bosch campus in Bengaluru

Sensex support is at 83300 then 83000 zones while re...

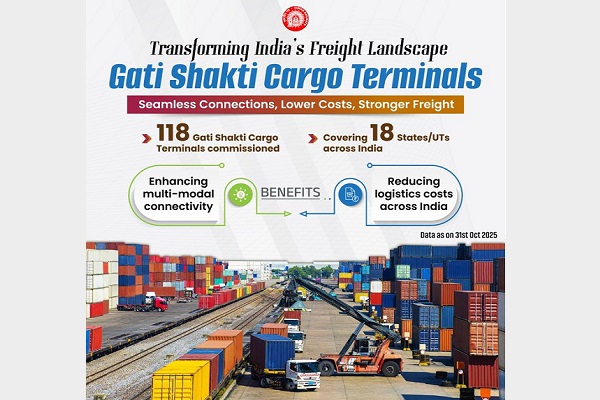

Railways record 4-fold jump in freight revenue from ...

Quote on Market Movement 14th January 2026 by Deveya...

.jpg)

Views on Morning Market 14th January 2026 by Dr. VK ...

Hyundai Motor aims to develop India into a `strategi...

Stock Picks : Tata Steel Ltd, Oil and Natural Gas Co...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found