No Record Found

Latest News

Centre releases Indian Standard for Electric Agricul...

Nifty & Bank Nifty Weekly Outllok 28th December 2025...

Supercalifragilisticexpialidocious 2025: A launchpad...

Is high-fat cheese healthy for your brain?

IIP data, Fed minutes and FII moves likely to guide ...

Bitcoin slumps 30 pc from record highs in 2025

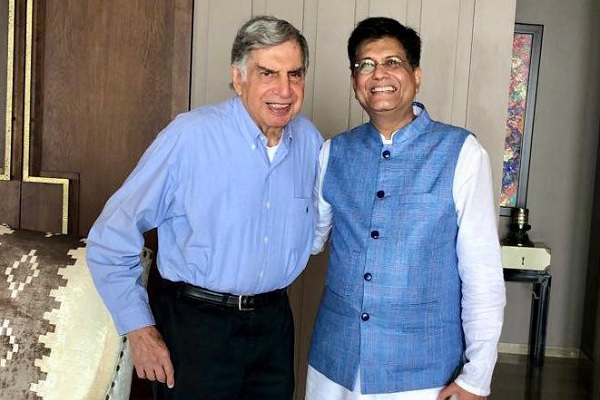

Ratan Tata?s leadership seamlessly blended innovatio...

IANS Year Ender 2025: Mutual fund, SIP investments t...

17 startups from tier 2 cities receive government gr...

Experts predict US dollar-won at 1,420 level on annu...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found