No Record Found

Latest News

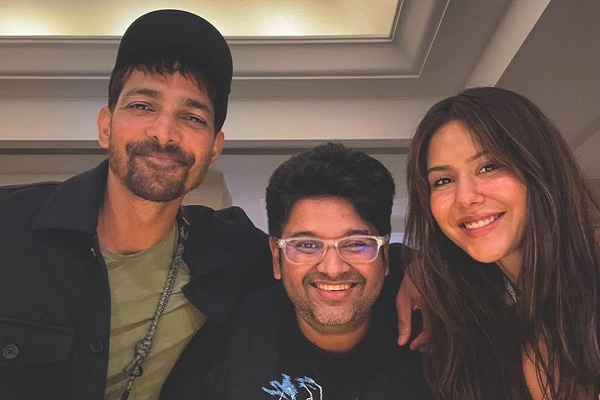

Milap Zaveri thanks Harshvardhan Rane & Sonam Bajwa ...

Indian women`s hockey team concludes 2025 with impre...

Olympic Champion Andre De Grasse named International...

Oral bacterium may worsen disability in multiple scl...

HPCL shines on joining hands with V-GREEN

Aditya Birla SL AMC announces press release on delay...

AJC Jewel Manufacturers surges on incorporating subs...

Signatureglobal rises on executing sale deed to sell...

RITES soars on bagging LoA worth $3.6 million from B...

IREDA Strengthens Finance and Audit Leadership with ...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found