No Record Found

Latest News

Company Update : Century Plyboards Ltd by Motilal Os...

Gujarat to host SemiConnect 2026 as Rs 1.24 lakh cro...

TRAI seeks feedback on ratings of properties based o...

Market Commentary (closing) for 27th February 2026 b...

India`s fiscal deficit in April-January at 63 pc of ...

Quote on Weekly FII Flows & Market Outlook by Vinit ...

Watch: Nandgaon bursts into life as colors dance on ...

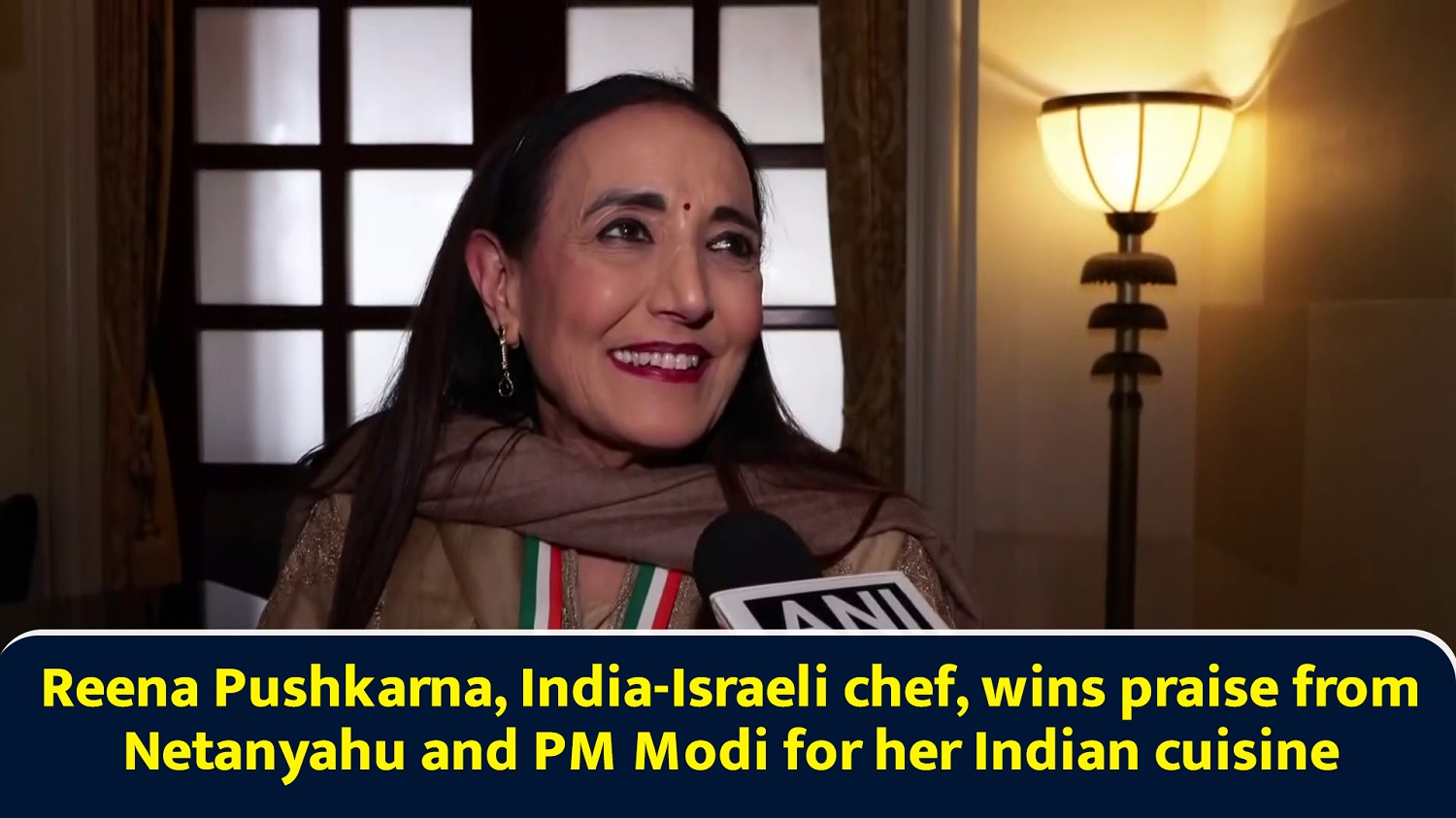

Reena Pushkarna, India-Israeli chef, wins praise fro...

PM Modi arrives in India after concluding two-day vi...

GPT Infraprojects gains on acquiring 100% stake in A...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found