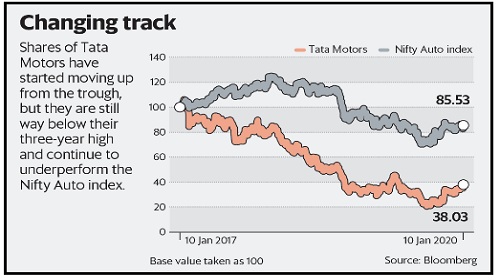

Headwinds recede for Tata Motors, but it is not out of the woods just yet

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel https://t.me/InvestmentGuruIndia

Download Telegram App before Joining the Channel

The Tata Motors Ltd stock has been racing full throttle over the last few months. It rose 83% from its 52-week low in September, making it the best performer among automobile original equipment manufacturers in a year.

The moot point: Is this rally sustainable? Indeed, investors are optimistic that the worst is behind the firm. Headwinds in both domestic and global markets are receding.

The first flicker of hope came when the Brexit deal was inked. Investors were relieved as a no-deal Brexit would have meant uncertainty on customs duties between the UK and countries in the European Union (EU). Tata Motors’ 100% subsidiary Jaguar Land Rover Ltd (JLR) gets one-fifth of its sales from the EU, besides importing parts from the region.

Meanwhile, JLR stumped investors with a 14% Ebitda (earnings before interest, tax, depreciation and amortization) margin in Q2 FY20—the highest in 16 quarters. Even the stand-alone business bettered expectations on profit margins.

However, this is not to say that Tata Motors is out of the woods yet. Analysts still have concerns. Trade tariffs following Brexit, which are unlikely to be spelt out immediately, will impact JLR’s revenue traction and profits.

Further, analysts were sceptical of JLR’s sales trajectory in China. An analyst seeking anonymity said the rebound in sales seen in the last few months came on a low base and with new launches. Hence, one needs to watch sales growth in the region. After all, China accounts for about a fifth of JLR’s sales.

Even so, the consensus estimate of analysts, as per Bloomberg, pegged Q3 FY20 Ebitda margin at 11%. This implied a hefty 600 basis points jump from a year ago. Apart from gains stemming from trimming the workforce and lowering marketing expenses, product and market mix improvement should drive JLR’s Q3 performance, said a report by Motilal Oswal Financial Services Ltd.

There is pessimism on the stand-alone entity’s performance, too. Jigar Shah, CEO of Maybank Kim Eng Securities India Pvt. Ltd, said: “Tata Motors’ domestic sales performance was poor with both commercial and passenger vehicle sales down sharply and we estimate a loss in the domestic unit similar to 2Q".

Even the management’s efforts to push passenger vehicle sales through new BS-VI compliant vehicles is unlikely to turn fortunes swiftly. After all, its core commercial vehicle business is still languishing.

Any disappointments, therefore, will not go down well with investors. For now, even after the recent price surge, the Tata Motors stock still trades at a hefty discount of 60% to its three-year high scaled in January 2017.

ofisescort.com - atakum escort - carsamba escort - eskort bayan - istanbul escort - diyarbakir escorts - diyarbakir escort

.jpg)