No Record Found

Latest News

60 pc GCC bases operate from green-certified Grade A...

Aditya Birla SL AMC announces addition of schemes un...

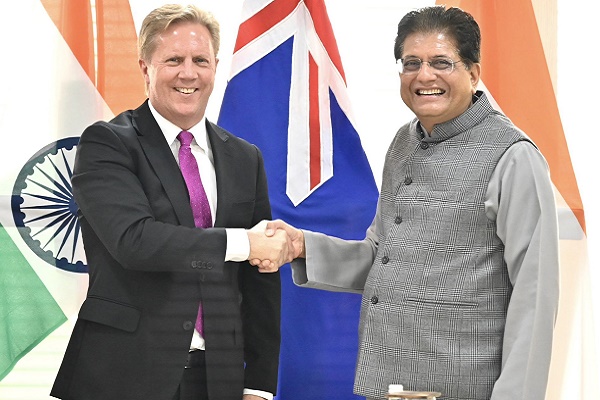

India-New Zealand FTA to ensure zero duty on 100 pc ...

Shriram Mutual Fund files offer document for Money M...

Bandhan Mutual Fund files offer document for Arudha ...

Bondada Engineering soars on securing order worth Rs...

Emcure Pharmaceuticals inches up on launching semagl...

Grace in Pastels: A Modern Interpretation of the Cla...

RBI may cut repo rate to 5 pc in upcoming MPC meet:

Weekly Broader Outlook 22nd December?2025 by GEPL Ca...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found