No Record Found

Latest News

India`s commercial vehicle industry clocks robust sa...

Buy Federal Bank Ltd for the Target Rs. 240 by Emkay...

Buy Marico Ltd for the Target Rs.810 by Emkay Globa...

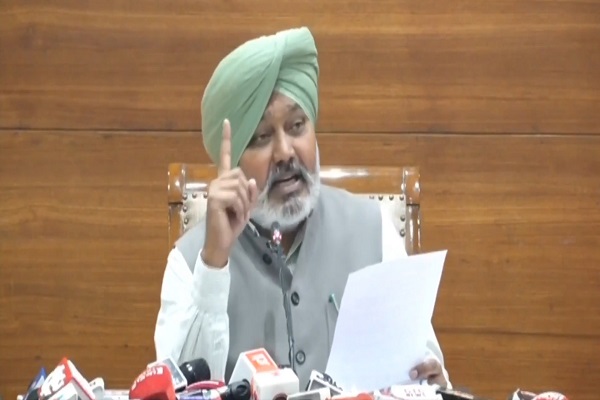

Punjab`s excise reforms directly strengthening publi...

Daily Derivatives Report 24th February 2026 by Axis ...

Union Ministers hail PM Narendra Modi`s AI-driven ed...

SELL USDINR FEB @ 91 SL 91.2 TGT 90.8-90.6 - Kedia A...

Buy Aditya Vision Ltd for the Target Rs.550 by Emkay...

Buy Go Fashion Ltd for the Target Rs.900 by Emkay G...

Buy GHCL Ltd for the Target Rs.900 by Emkay Global ...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found