No Record Found

Latest News

Uttarakhand: PM NarendraModi holds mega roadshow in ...

Caring for Your Heart, Caring for Your Life

Haryana DGP OP Singh`s light moment with journo evok...

Work-Life Balance: The Key to a Healthy and Producti...

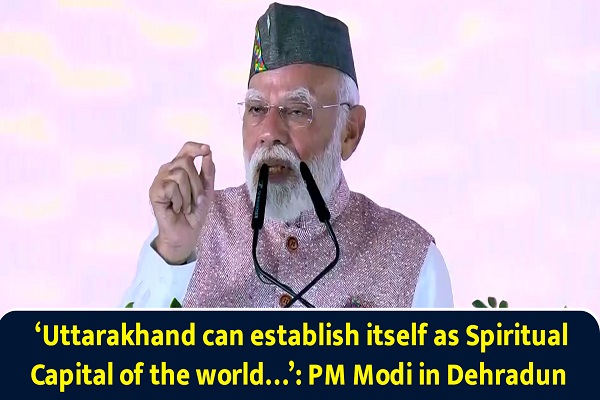

`Uttarakhand can establish itself as Spiritual Capit...

Wild Leg Fashion: The Bold Trend Making a Statement

ICC Women`s World Cup star Renuka Thakur visits home...

South Korea reaches consensus on 2035 greenhouse gas...

MOSt Advisor November 2025 by Siddhartha Khemka, Sr....

Innovation, Research, and Collaboration Drive India`...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found