No Record Found

Latest News

Wellness Retreats: A New Age Health Tourism Experience

The Classic Combo: Burgers, Fries, and Refreshing Dr...

Jabra Devices: Smart Gadgets for Modern Communication

India, EU likely to seal long-pending free trade dea...

PFRDA forms committee to thoroughly review NPS inves...

Himachal CM Sukhvinder Sukhu on statehood day announ...

Samba paddy harvest boosts prices of premium varieti...

MSMEs most powerful platform for job creation: Minister

Gold prices surpass $5,000 an ounce amid heightened ...

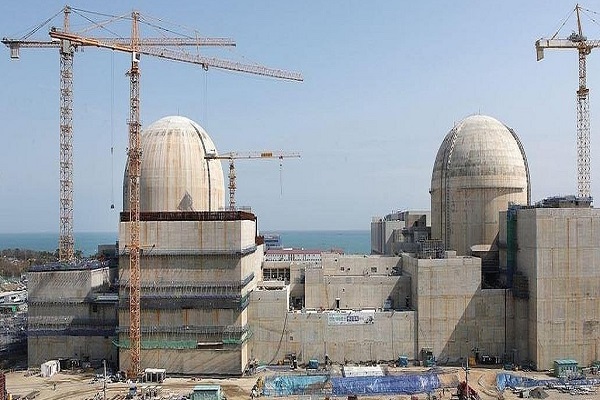

S. Korea to build 2 new nuclear reactors by 2038 as ...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found