No Record Found

Latest News

J&K Ranji team wins maiden Ranji Trophy 2026, stuns ...

Kerala Story 2 release: Audience is all praise dire...

South Korean exports jump 29 pc to record Feb high o...

Samsung Electronics to shift to AI-driven autonomous...

US envoy Sergio Gor hails Micron inauguration as boo...

Tripura records 332 pc surge in floriculture area in...

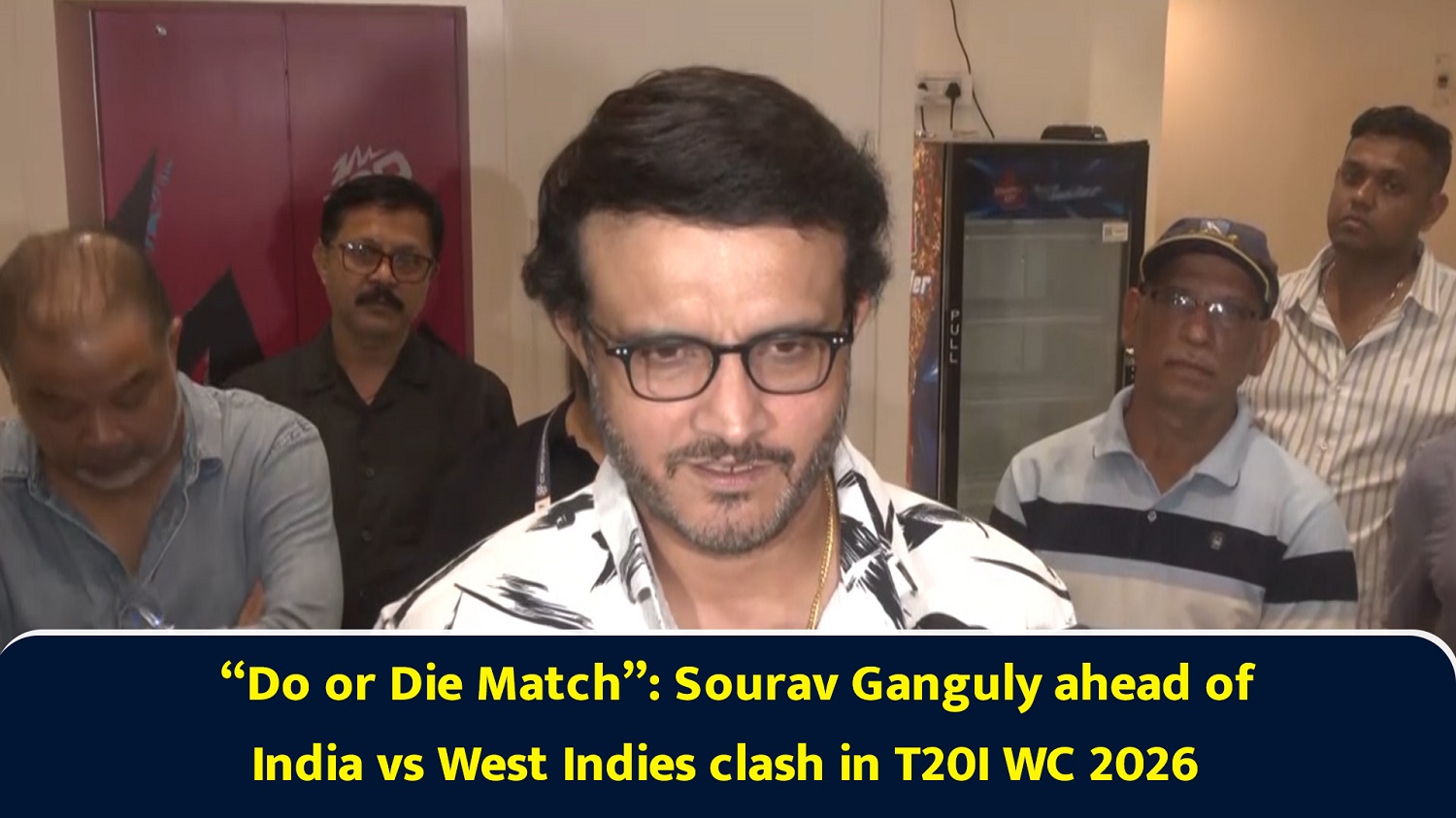

?Do or Die Match?: Sourav Ganguly ahead of India vs ...

GAIL to invest Rs 1,736 crore for wind power project...

PM Narendra Modi inaugurates Micron's facility in Gu...

India's jewellery market projected to reach $130?150...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found