No Record Found

Latest News

Ratan Tata?s leadership seamlessly blended innovatio...

IANS Year Ender 2025: Mutual fund, SIP investments t...

17 startups from tier 2 cities receive government gr...

Experts predict US dollar-won at 1,420 level on annu...

PM narendra Modi chairs meet of chief secretaries; d...

Indian Railways' capacity expansion to enhance train...

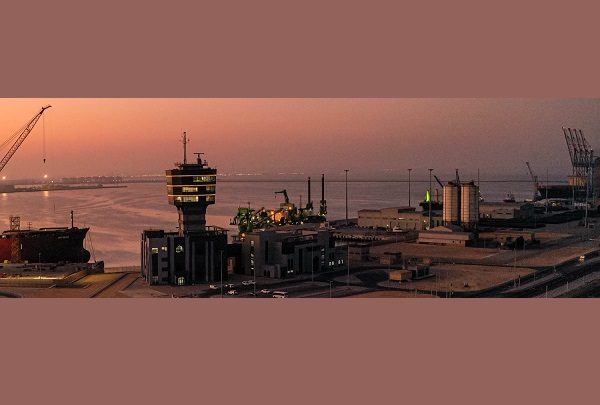

Oman`s Duqm port expands India?s range of maritime o...

Nepal Ambassador calls on Gujarat CM; explores ties ...

Innovation takes root in Nuh as 20-variety Mushroom ...

PM SVANidhi scheme brings new hope to street vendors...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found