21-09-2023 10:25 AM | Source: Geojit Financial Services

Morning Nifty and Derivative comments 21 September 2023 By Anand James, Geojit Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Views On Morning Nifty and Derivative comments 21 September 2023 by Anand James - Chief Market Strategist at Geojit Financial Services

Nifty outlook:

We are haflway enroute the 19550 objective that we had started with, a few days back, with 20000, the first level of defence giving away from the first approach itself. Eyes are now on 19830-19690-600 to attract buying interests. Downside prospects could be delayed, if Nifty manages to swing above 19956, though short covering may not gain strength unless above 20030. - Read more

Derivative outlook:

Nifty weekly contract has highest open interest at 20000 for Calls and 19900 for Puts while monthly contracts have highest open interest at 20000 for Calls and 19000 for Puts. Highest new OI addition was seen at 20000 for Calls and 19900 for Puts in weekly and at 20000 for Calls and 19900 for Puts in monthly contracts. FIIs decreased their future index long position holdings by 24.14%, decreased future index shorts by 7.96% and decrease in index options by 20.43% in Call longs, 10.26% in Call short, 8.97% in Put longs and 1.13% in Put shorts. - Read more

USD-INR outlook :

Lack of upside momentum along with a pull back below 83.07 has punctured the upside move exposing 82.9 and 82.78, which should be in play today - Read more

Above views are of the author and not of the website kindly read disclaimer

Latest News

Buy Clean Science and Technology Ltd For Target Rs.1...

Buy Somany Ceramics Ltd For Target Rs.950 By JM Fin...

Buy Gold Above 72200 SL BELOW 71900 TGT 72550/72800 ...

Indian startups raised nearly $7 billion in first ha...

Committed to learning from India how to make AI more...

World Bank classifies Mongolia as upper middle incom...

Government`s focus on non-polluting energy sources t...

Madhya Pradesh Finance Minister Jagdish Devda to pre...

Accounting firm RSM's US arm plans to more than doub...

Buy Bharti Airtel Ltd For Target Rs. 1,480 By JM Fin...

Top News

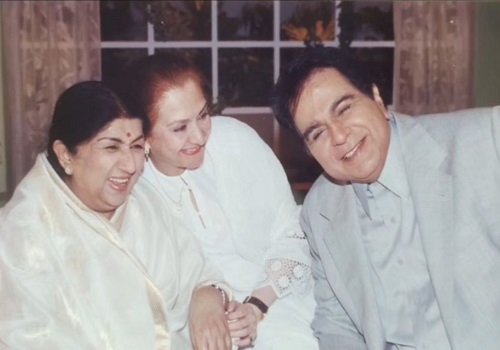

Saira Banu remembers Lata Mangeshkar on 94th birth anniv: 'Her art will be cherished forever'

Tag News

Sensex touches 80,000 for first time, Nifty at all-time high

Market Wrap Up by Shrikant Chouhan, Head Equity Research, Kotak Securities Ltd

Daily Market Analysis : Markets edged higher, gaining over half a percent, driven by favorable cues Says Mr. Ajit Mishra, Religare Broking Ltd

Quote on Kotak Mutual Funds for Sensex at 80000 by Nilesh Shah, Managing Director at Kotak Mahindra Asset Management Co. Ltd

More News

Daily Market Analysis : Markets edged marginally lower in a dull session, taking a breather ...

Daily Market Analysis : Markets started the week with a cut and lost over half a percent amid mixed cues Says Mr. Ajit Mishra, ...

Daily Market Analysis : We thus recommend maintaining focus on stock selection while keeping a check on leveraged trades Says ...

Perspective on markets By Mr. Jaykrishna Gandhi, Emkay Global Financial Services