The rupee is expected to appreciate today amid weakness in dollar and optimistic global market - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee Outlook and Strategy

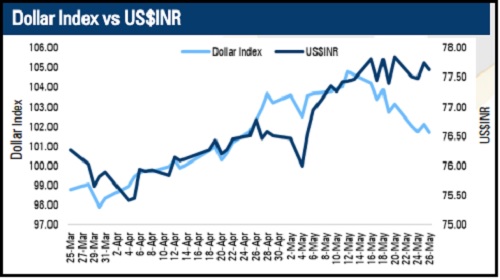

* The US dollar eased by 0.36% yesterday amid a rise in risk appetite in the global markets and disappointing GDP data. A second reading of Q1 US GDP came in worse than the first reading with contraction at an annual rate of 1.5%. Further, investors fear that Fed’s aggressive monetary tightening may already be slowing economic growth, prompting to scale back tightening bets

* Rupee future maturing on May 27 appreciated by 0.07% amid weak dollar and rise in risk appetite in global markets. Meanwhile, consistent FII outflows and surge in crude oil prices prevented further gains

* The rupee is expected to appreciate today amid weakness in dollar and optimistic global market sentiments. Further, traders speculate that US Fed may slow its tightening cycle in second half of the year and assess the effects of policy firming. However, sharp gains may be prevented on elevated crude oil prices and persistent FII outflows. US$INR (June) is expected to trade in a range of 77.60-78.05

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Top News

India`s trade deficit widens to $19.73 billion in March, exports rose 6% in 2022-23 to $447 ...

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory