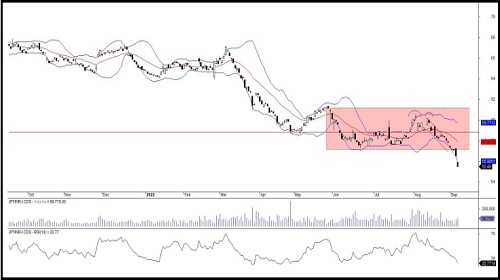

Sell JPYINR Below 55.71 Target 55 SL 55.99 - GEPL Capital

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

News / Other data

* The precipitous slide in Japan's currency has run so far and fast it's spooking big investors, and some are cutting bets that it will decline further, anticipating policymakers may soon step in to try and arrest the freefall.

* The dollar gained against the yen on Thursday, climbing in nine of the last 10 sessions, after Federal Reserve Chair Jerome Powell reiterated that the U.S. central bank will continue to raise interest rates in order to tame surging inflation and warned against prematurely loosening monetary policy.

* Goldman Sachs (NYSE:GS) recommends investors short the euro against the Swiss franc following the European Central Bank's record rate increase as they think it likely the Swiss National Bank will want to take action to arrest the franc's depreciation.

* The European Central Bank issued a rare warning about the euro's sliding foreign exchange rate on Thursday, adding to the global unease among policy-makers at the dollar's strength.

* Japan is ready to take action to address "clearly excessive volatility" seen in the yen, the country's top currency diplomat said on Thursday, issuing the strongest warning to date after the currency plunged to 24-year lows.

* The U.S. dollar edged lower in early European trade Thursday, with the euro rebounding ahead of the latest European Central Bank rate decision, which is expected to result in another aggressive increase.

Observation

* On looking at daily chart of JPYINR, Prices formed a base in the form of Rectangle Pattern, which is a bearish pattern.

* Prices after the breakout on 6th September,2022 have sustained below the neckline of the above pattern, which shows the bearish undertone of the pattern.

* The breakout was confirmed by a gap.

* Bollinger bands have started to expand which tells that the volatility in the prices have started to increase for down move.

* RSI have sustained below 50 levels, reflecting that the prices have the momentum to go lower.

Inference

* Sell below 55.71 Target 55 SL 55.99

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://geplcapital.com/term-disclaimer

SEBI Registration number is INH000000081.

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

Corporate rating upgrades continue to outpace downgrades in July: India Ratings and Research

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory