Safe Haven gains on Concern over Nuclear Plant - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Safe Haven gains on Concern over Nuclear Plant - HDFC Securities

Indian rupee expected to open slightly higher following overnight fall in crude oil prices on expectation of ease of supply. While the dollar rose against all its Group-of-10 peers except the yen after news of a Russian attack on a nuclear plant in Ukraine boosted haven demand. Sentiment remains sour for rupee as expectation of fund inflows from LIC IPO’s might not hit the market as per schedule and multi year high crude oil prices could change the fiscal math.

Rupee lost further ground against a backdrop of weaker stocks and a weaker bond market. Higher crude oil prices also weighed on local unit. Spot USDINR on Thursday gained 20 paise to 75.91. So far, central bank has been protecting the level of 76 by way of interventions but now the situation has been worsening due to geopolitical worries. Technically, spot USDINR is in bullish trend and sustainable trade above 76 will lead to further appreciation and push the pair towards life high while on downside the support has been shifted to 75.30.

Stocks looked poised to fall in Asia on concerns over global growth and inflation risks from the war in Ukraine and the isolation of Russia’s economy. US Markets swing back between risk-on and risk-off, looking to geopolitical developments. Crude eased back from a 14-year high on the prospect of a supply boost.

US Federal Reserves balance sheet showed a $19 billion sequential decline left the Fed’s portfolio of interest-bearing assets at $8.67 trillion.

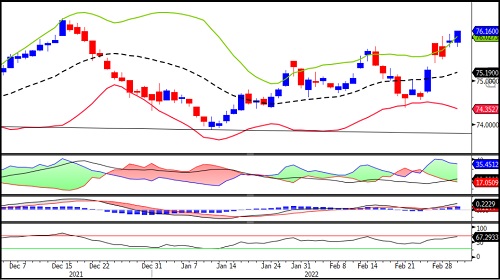

USDINR

Technical Observations:

USDINR March futures closed above Doji candlestick pattern high indicating bullishness.

The pair has also closed above upper band of the Bollinger band indicating continuation of up trend.

Near term USDINR March futures has support at 75.70 and resistance remains around 76.50.

Relative Strength Index of 14 days period placed at 67 and heading north indicating bullish momentum.

Derivative price actions indicating addition of long position following rise in price and open interest.

USDINR March futures expected to trade in the range of 75.90 to 76.40 range. Bullish trend to continue till it holds level of 75.70.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory