Rupee likely to open right as risk assets rebound - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Rupee likely to open right as risk assets rebound - HDFC Securities

Indian rupee likely to open slightly higher following rebound in risk assets even after geopolitical worries remain intact. We expect higher volatility to continue ahead of month end. Higher crude oil price, foreign fund outflows and steady dollar are bad combination for rupee bulls but central bank’s intervention will make the game difficult for traders.

On Tuesday, spot USDINR gained 36 paise or 74.88 level following risk averse sentiments along with foreign fund selling domestic equities and RBI’s announcement of $5 billion sell buy swap. Technically, pair has been weaken amid formation of lower lows and breaking of short term trend line support. It has support at 74.30 and resistance at 75. Option distribution data for February expiry indicating USDINR could settle below 75 level following maximum position on 75 strike option

Haven currencies underperform despite rising geopolitical tensions over RussiaUkraine conflict. U.S. President Joe Biden unveiled sanctions targeting Russia’s sale of sovereign debt abroad and the country’s elites, responding to what he described as the start of Vladimir Putin’s invasion of neighboring Ukraine

Stocks in Asia are set for a cautious start as traders assess escalating tension over Ukraine after US announcing sanction on Russia.

Elsewhere, Oil is firmly in the market spotlight, caught in a tug-of-war between Russia and Iran as the key $100-per-barrel level looms for the first time since 2014. Brent crude rose as much as 4.3% to $99.50 per barrel before scaling back gains to ~1%

Technical Observations:

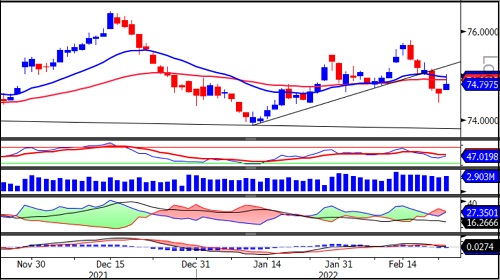

USDINR February futures formed hanging man candlestick pattern after hammer candlestick pattern indicating indecisiveness.

The pair unable to sustain above short term moving averages. It has also broken the short term trend line support indicating weaker trend.

Relative Strength Index of 14 days period oscillating below 50 with downward direction indicating weak momentum.

MACD has been placed slightly above zero line while histogram turned weak indicating weaker trend

Short covering has been seen with rise in price and volume while open interest declined.

USDINR February futures likely to trade within range of 75 to 74.60.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory