Rupee Appreciates As Crude Rally Takes Breather - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Rupee Appreciates As Crude Rally Takes Breather - HDFC Securities

Indian rupee expected to open slightly higher as crude rally takes breather. However, the local units expected to remain under check as safe haven currencies continue rolling. Talks between Russia and Ukraine did not deliver anything concrete yesterday, nor was there any follow up on the UAE OPEC+ noise on crude production

On Thursday, spot USDINR fell 26 paise to 76.31 erasing most of the weekly gains. However, the setup remains bullish as long as it floats above 75.70 while on higher side it is having resistance at 76.50 and 76.70.

Equities in Asia fell Friday as the fastest U.S. inflation in 40 years drove Treasury yields higher and raised expectations for steeper interest-rate hikes.

The euro fell for the seventh time in the last nine sessions, erasing its postEuropean Central Bank meeting gains as the hawkish tone from policy makers failed to support the currency. ECB policy makers unexpectedly accelerated a wind-down of monetary stimulus, signaling the bank is more concerned for now about record inflation than threats to economic growth.

The yen declined to a five-year low against the dollar as expectations for Federal Reserve interest-rate hikes highlights the divergence in monetary policy between the U.S. and Japan. Japanese currency weakened to 116.38 per dollar, surpassing its January low of 116.35, and putting it at the weakest level since January 2017.

Elsewhere, crude oil’s spectacular rally eased and crude is set for the biggest weekly loss since November.

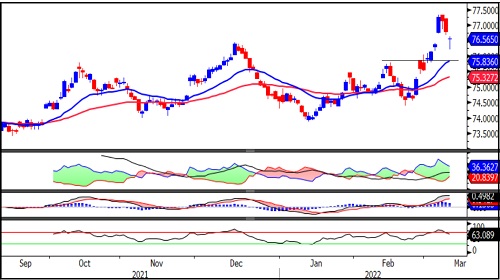

USDINR

Technical Observations:

USDINR March futures formed Dragonfly Doji candle considered to be bullish candlestick.

The pair has been trading well above short term moving averages.

It has filled the gap and took support before previous top suggesting continuation of up trend.

Relative Strength Index of 14 days period placed at 63 and heading south indicating weaker momentum.

Derivative price actions suggesting fresh short position as prices declined while open interest and volumes rise.

USDINR March futures expected to consolidate in the range of 76.30 to 76.70. Medium term trend remains up as long as the pair holds 75.70.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory