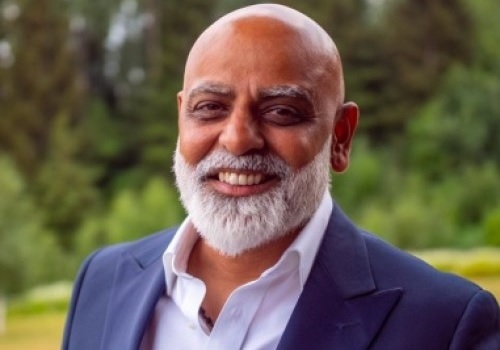

Outlook on Gold By Mr. Mahesh Kumar, Abans Group

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Below is Outlook on Gold by Mr. Mahesh Kumar, EVP & Head Capital & Commodities Market (Abans Group)

Gold is currently trading in the red, and the US Federal Reserve meeting is expected to provide new guidance.

CME Gold future contract is now trading at $1916 sharply lower from recent high of $2078.80 registered on 8 March 2022. Gold prices have risen as a result of the Ukraine crisis, but the US Federal Reserve meeting later today is expected to provide new direction for gold prices. The FED is expected to raise borrowing costs by 25 basis points. However, due to Russia's invasion of Ukraine after commodity prices skyrocketed, the Fed must strike a balance between being too aggressive and not being aggressive enough on inflation. The Fed is likely to discuss its bond holdings acquired through bond purchases. Powell's comments will set the tone for gold and equities in the coming months, as the Fed's policy decisions will only be reflected in the market over the next three to six months.

The Russian-Ukrainian cease-fire talks have reduced demand for safe-haven assets. Ukrainian President Volodymyr Zelenskiy, on the other hand, stated that the positions of Ukraine and Russia in peace talks were sounding more realistic, but that more time was needed.

On Wednesday, China reported more than 3,000 new domestic Covid-19 cases, a decrease from the previous day's 5,100 infections, the largest increase in the country's daily tally since the pandemic's early stages in 2020. If omicron cases remain mild, the lockdown in parts of China may be lifted, which will reduce risk sentiment and be negative for gold prices.

According to the CFTC Commitments of Traders report for the week ended March 8, net long of gold futures increased by 16766 contracts to 274388. Speculative longs added by 10441 contracts while shorts dropped by 6325 contracts.

On US economic data front, US Feb PPI ex-food & energy rose +0.2% m/m and +8.4% y/y, weaker than expectations of +0.6% m/m and +8.7% y/y. Also, the Mar Empire manufacturing survey general business conditions unexpectedly fell -14.9 to a 1-3/4 year low of -11.8, weaker than expectations of an increase to 6.4.

CME gold future contract is likely to find immediate support level around $1906-$1882 meanwhile critical resistance level is seen around $1955-$1980.

Above views are of the author and not of the website kindly read disclaimer