EURINR May futures trading well above medium term moving averages - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee gains on foreign inflows and weaker dollar index

Indian rupee advanced for a fourth straight week on the back of rising foreign fund inflows, decline in virus cases, risk-on sentiments and a weaker dollar index. Rupee gained 46 paise or 0.62% to 72.84 a dollar. In the week gone, foreign institutions have bought $349 million equities and $47 million debt. Forex market is pricing in for better dollar inflows in coming days following MSCI & FTSE rebalancing along with series of IPO scheduled next month. At the same time, central bank may let rupee to appreciate to offset the rising costs of commodity imports.

Spot USDINR expected to trade with bearish bias and heads toward downside gap support at 72.77 and 72.37 while resist at 73.37, the 100 days simple moving average.

India’s foreign exchange reserves inches toward life high by gaining six weeks in row. The forex reserves rose by $563 million to reach $590.028 billion in the week ended May 14, as per RBI weekly statistics. The reserves had touched a lifetime high of $590.185 billion in the week ended January 29, 2021.

Dollar recovers on Friday as output at U.S. manufacturers and service providers set a record in May, reflecting strength in the economic recovery but on weekly basis closed in negative and is less than 1% away from the lows of the year

In a quiet week for events, forex markets will eye on developed nations central bank’s tapering timelines and stimulus package. Central bank policy divergence will remain a dominating market theme as traders analyse through guidance and bet on the timing of both tapering and G-10 rate hikes, which will likely to direct the trend of currencies.

CFTC Data: In FX, the major flow was buying of CAD (7.5k) and selling of JPY (9.2k). Flows elsewhere were mixed, with buying of euros (6k), but sales of sterling (3.3k) and CHF (1.4k). The overall dollar position was little changed on the week

The US Fed's balance sheet has reached $7.88 trillion, up a chunky $91 billion from last week’s reading or roughly 36% of GDP. At the current pace of purchases, the size of the balance sheet is poised to increase toward $9 trillion by the end of 2021, up from $7.4 trillion at the end of 2020

USDINR

USDINR May futures drifted lower for the fourth week in row and retraced more than 80% from high of 75.50.

The pair also closed well below long term moving averages and with volume supporting bears.

Ichimoku study also indicating down trend as we have seen death cross over and lagging span also swing downward. The pair has cloud resistance at 73.72.

Momentum oscillator, RSI of 14 days period entered in oversold zone suggesting continuation of down trend

USDINR May futures expected to trade with negative bias with downside support at 72.36 followed by 72.30 while resist in the range of 73.30 to 73.73.

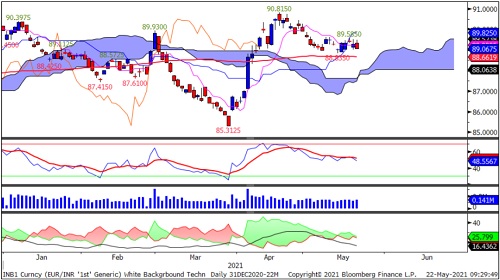

EURINR

EURINR May futures trading well above medium term moving averages.

Leading span A crossed Leading Span B upward suggesting fresh long position with support at 88.06 level.

The pair has been consolidated in the range of 88.80 to 89.60 since start of the month. Short term traders should wait for said range break out.

Momentum oscillators and indicators on placed near breakeven line indicating consolidation.

We remain neutral in near term while overall trend remains up till it holds the level of 88. Bulls will take charge above 89.60 and pull pair towards 90.80.

GBPINR

GBPINR May futures sustaining above short term moving averages. The pair has been trading with higher top higher bottom on daily chart.

It has been consolidating in small range of 103.50 to 104.25 range since last two weeks.

Momentum oscillators and indicators placed above breakeven line indicating continuation of consolidation in bullish trend.

We remain optimistic expect GBPINR May future can head towards 105 level once it cross 104.25 level. The bullish view will be negated only below 101.40, the 100 days simple moving average line and Ichimoku cloud support.

JPYINR

JPYINR May futures retraced from 100 days simple moving averages and placed below short term moving averages indicating near term weakness.

The pair has double top resistance at 69.84 while 100 days simple moving average placed at 68.90 level while support at 67 level the gap formed on April 7.

Momentum oscillator, relative strength index of 14 days placed below center line and heading southward indicating continuation of down trend.

We remain bearish in JPYINR May futures and once the level of 67 breaches it starts moving toward March low of 66.25. The pair is expected to face resistance at 67.70, 50 days simple moving average.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory